Category: Cryptocurrency - Page 2

-

NT Airdrop by NEXTYPE: What You Need to Know Before You Participate

There is no active NEXTYPE NT airdrop in 2026. The project is defunct, its website is expired, and any claims of free tokens are scams. Learn why NEXTYPE failed and how to avoid falling for crypto fraud.

-

XBOND Crypto Exchange Review: Is This Platform Still Active in 2025?

XBOND crypto exchange shows no trading volume, no user reviews, and no transparency in 2025. Learn why this platform is untracked, inactive, and not recommended for any trader.

-

How Indonesians Trade Cryptocurrency Legally in 2025

Indonesians can legally trade cryptocurrency only through OJK-licensed exchanges, paying a 0.21% tax on domestic trades. Using crypto as payment is banned, and foreign platforms carry a 1% tax. Learn the steps, rules, and risks in 2025.

-

Centralized Exchange Token Risks: What You Need to Know Before Depositing Crypto

Centralized exchanges make crypto easy but come with serious risks-hacks, freezes, and hidden terms. Most users don’t own their coins. Learn how to protect yourself before it’s too late.

-

Smart Contract Rug Pull Mechanisms: How Scammers Drain DeFi Funds and How to Avoid Them

Smart contract rug pulls are coded exit scams that drain DeFi funds through liquidity pulls, honeypots, and pump-and-dump schemes. Learn how they work, how to spot them, and how to protect your investments before it's too late.

-

CoPuppy (CP) Airdrop Scam: Why There's No CoinMarketCap Airdrop and How to Avoid Fake Crypto Promises

CoPuppy (CP) has no official airdrop with CoinMarketCap. The token trades at $0, has contradictory supply numbers, and is flagged as a scam. Learn how fake airdrops steal wallets and where to find real crypto rewards instead.

-

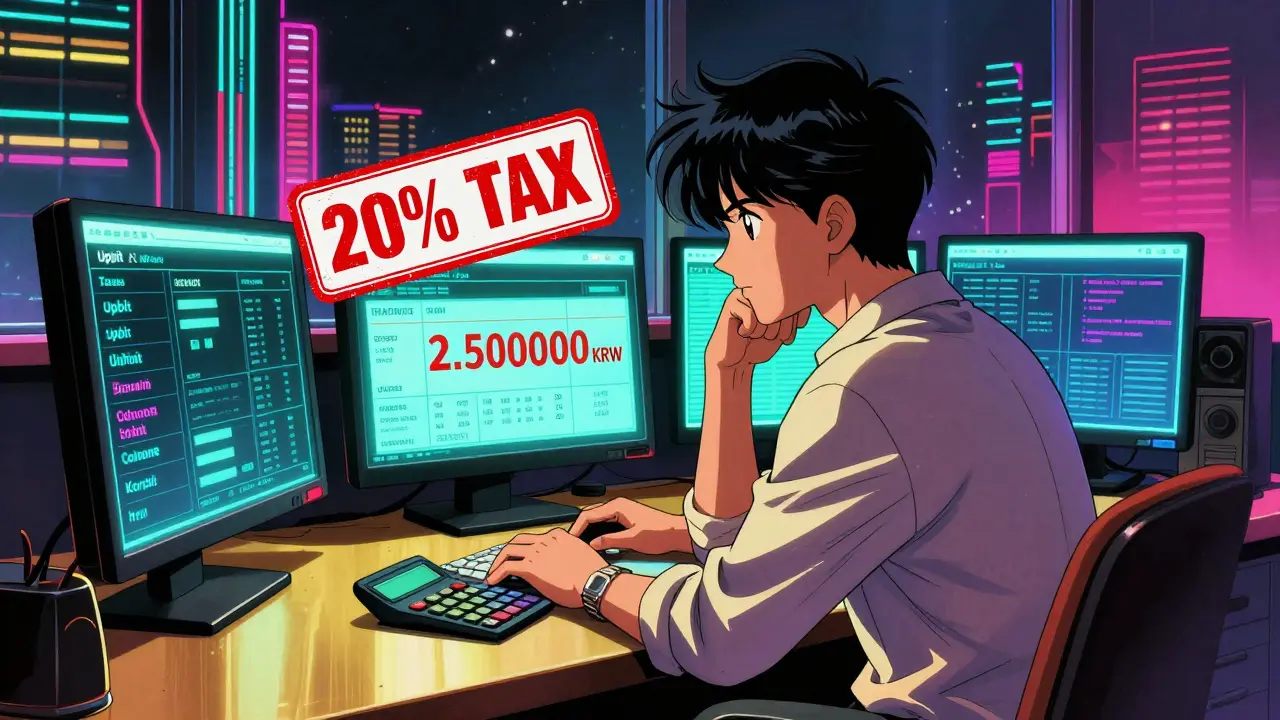

Korean Crypto Trading Restrictions and Rules: What You Need to Know in 2025

South Korea enforces strict crypto rules: only four exchanges are legal, real-name bank linking is mandatory, 20% tax applies on profits over 2.5M KRW, and altcoin options are limited. Here’s what traders need to know in 2025.

-

What is Gmining (GMNT) crypto coin? Tokenomics, risks, and why it's nearly worthless

Gmining (GMNT) is a nearly worthless BEP-20 token with zero trading volume and a 99.92% price crash. No team, no product, no future - just a ghost in the crypto market.

-

SupremeX (SXC) Airdrop: How to Get Free SXC Tokens in 2025

Learn how to get free SupremeX (SXC) tokens in 2025 through Bitget's verified airdrop. No purchase needed. Just complete simple tasks to earn governance tokens for a real DeFi lending platform.

-

Understanding Cryptocurrency Confirmation Times: How Long Until Your Transaction Is Safe?

Learn how long cryptocurrency confirmations take, why they vary between coins, how fees affect speed, and how many confirmations you really need for safety. Practical guide for users and merchants.

-

Crypto Adoption in Russia: How Sanctions and Regulations Shape Digital Currency Use

Over 20 million Russians use cryptocurrency despite legal restrictions, turning to Bitcoin and stablecoins to bypass sanctions, protect savings, and conduct cross-border trade. Learn how regulation, not technology, shapes Russia's unique crypto landscape.

-

National Competent Authorities for Crypto in EU: Who Regulates Crypto under MiCA?

Under MiCA, each EU country has its own crypto regulator called a National Competent Authority. Learn who they are, how they license firms, and why the EU is moving toward centralized oversight.