TajCoin blockchain: What It Is, Why It Matters, and What You’ll Find Here

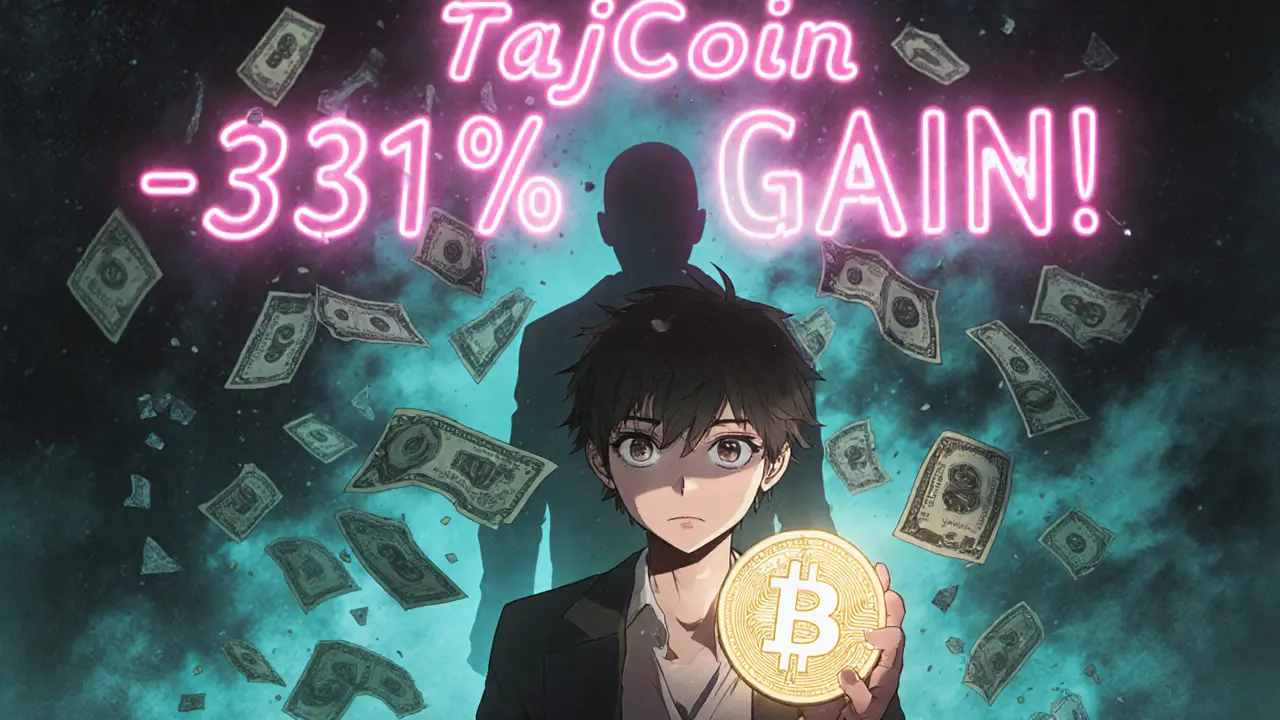

When you hear TajCoin blockchain, a name that appears in forums and social media with no official website, whitepaper, or team. Also known as TajCoin crypto, it TajCoin token, it’s often floated as a new opportunity—but it’s missing every sign of legitimacy. Real blockchains don’t hide. They publish code, list developers, show transaction history, and have active communities. TajCoin blockchain has none of that. It’s a ghost name, used to lure people into fake airdrops, phishing sites, or pump-and-dump schemes. You won’t find it on CoinMarketCap, CoinGecko, or any major exchange. That’s not an oversight—it’s a warning.

What you will find in this collection are real stories about how people get fooled by names like TajCoin blockchain—and how to avoid it. Posts here cover crypto scams, fraudulent airdrops that mimic real projects to steal wallets and private keys, decentralized networks, the actual infrastructure that keeps Bitcoin and Ethereum running without banks or middlemen, and blockchain technology, the open, verifiable ledger system that makes trust possible without central authorities. You’ll see how fake tokens like TajCoin exploit confusion around these real concepts. One post breaks down why the CSHIP airdrop never existed. Another shows how BXH Unifarm and AST Unifarm airdrops are just copied names with no code behind them. These aren’t anomalies—they’re patterns. Scammers reuse names, steal logos, and copy descriptions from real projects because they know most people don’t check.

What’s the difference between TajCoin blockchain and something like Stader ETHx or Wrapped BONES? One has a clear purpose, public contracts, and active users. The other has zero traceability and zero credibility. You don’t need to be a coder to spot the difference. Look for the basics: is there a GitHub? A team with real names? A transaction history on a blockchain explorer? If the answer is no, it’s not a project—it’s a trap. The posts here give you the tools to ask those questions before you click, before you connect your wallet, before you lose money. You’ll learn how IP tracking can expose your identity even if you think you’re anonymous, how P2P networks actually work, and why transaction fees on some chains are now under a cent. You’ll also see how real users in Iran, Jordan, and Russia navigate restrictions with tools that actually work—not hype. This isn’t about chasing the next miracle coin. It’s about protecting what you have and understanding what’s real in a space full of noise.

What follows isn’t a list of tokens to buy. It’s a list of lessons learned the hard way—by people who got burned, then dug deeper. You’ll find reviews of real exchanges, breakdowns of tax rules in Portugal, and guides on stop-loss strategies that actually reduce risk. If TajCoin blockchain popped up in your feed, you’re not alone. But now you know how to move past it.

-

What is TajCoin (TAJ) crypto coin? Full breakdown of supply, price, and risks

TajCoin (TAJ) is a micro-cap crypto with unclear technology, no development team, and almost no trading volume. Learn why it's not a real investment and how to avoid similar scams.