Payment Crypto Speed: How Fast Can Crypto Money Move?

When talking about payment crypto speed, the time it takes for a crypto transaction to become usable for the recipient. Also known as crypto payment latency, it matters whether you’re buying coffee or settling a business invoice. Payment crypto speed isn’t just about raw numbers; it’s tied to transaction finality, the point at which a transaction is irreversible and can be trusted. Some call it finality, and it can range from a few seconds on modern networks to several minutes on older chains. Another driver is layer 2 scaling, off‑chain solutions that bundle many transactions before settling on the main chain (aka layer‑2). Together, these concepts shape whether crypto feels fast enough for everyday payments.

Key Factors Shaping Payment Speed

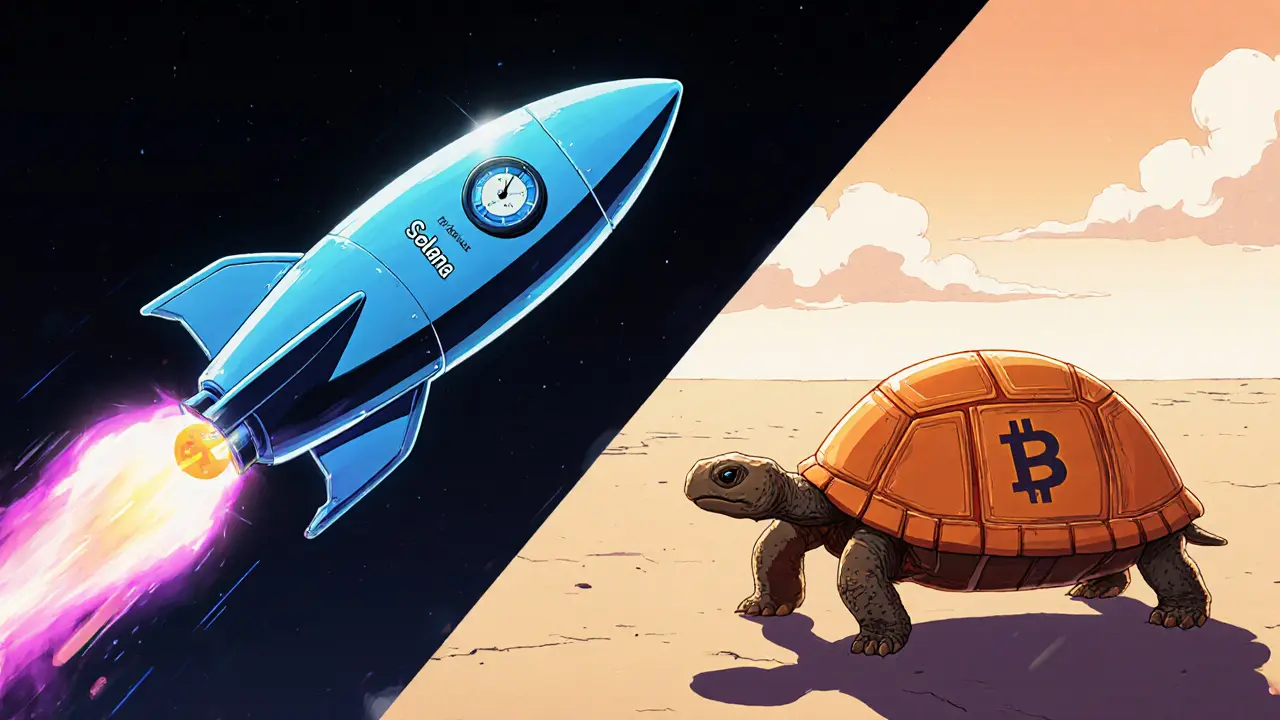

First, transaction finality depends on the consensus algorithm. Proof‑of‑Work chains like Bitcoin often need 10‑minute block times, so finality can take 30‑60 minutes. Proof‑of‑Stake networks such as Solana or Avalanche aim for sub‑second finality, but they may trade off decentralization for speed. Second, blockchain scalability governs how many transactions a network can process per second. Higher throughput reduces congestion, which directly cuts the waiting time for each payment. Third, layer 2 solutions like rollups, state channels, or sidechains take the heavy lifting off the main chain. By batching hundreds of payments into a single on‑chain proof, they push effective speeds into the sub‑second range while keeping fees low. Finally, crypto transaction fees influence speed because many wallets let users bump a fee to get a quicker spot in the mempool. Low‑fee environments are great for tiny purchases, but they can slow down when the network spikes.

All these pieces matter to merchants, developers, and everyday users. Faster finality means you can trust that a payment arrived before you ship a product. Better scalability lets exchanges process huge order books without lag. Layer‑2 tech gives DeFi apps the responsiveness of traditional finance while keeping the security of the underlying blockchain. Below you’ll find a curated set of articles that break down these topics in real‑world terms: from exchange reviews that highlight fee structures, to deep dives on how transaction finality is evolving, and practical guides on using layer‑2 bridges for instant payments. Dive in to see how each factor impacts the speed of your crypto money and what tools you can use right now.

-

Crypto Payment Transaction Speed Comparison 2025: TPS & Confirmation Times

Compare cryptocurrency payment speeds in 2025: TPS, confirmation times, pros, cons, and which chain fits your checkout needs.