Crypto Payment Network Selector

Find Your Best Payment Blockchain

Your Recommended Payment Blockchain

Solana

Best for micro-payments and gaming

Why This is Your Best Fit

Your selection of speed priority and sub-second confirmation time makes Solana the ideal choice. With average confirmation times under 0.5 seconds and peak TPS of 1,504, Solana provides the instant checkout experience your users expect.

Confirmation Time

0.4s

Peak Daily TPS

1,504

Best For

Micro-payments, gaming, high-volume retail

How This Compares

| Blockchain | Confirmation Time | Peak Daily TPS | Best For |

|---|---|---|---|

| Solana | 0.4s | 1,504 | Micro-payments, gaming |

| Avalanche | 2s | 2,800 | Fast cross-chain payments |

| Polygon | 1s | 5,200 | Ethereum-compatible payments |

| Ethereum | 12s | 22 | Secure smart contract applications |

| Algorand | 4.5s | 950 | Cross-border remittances |

| Bitcoin | 10m | 6 | High-value settlements |

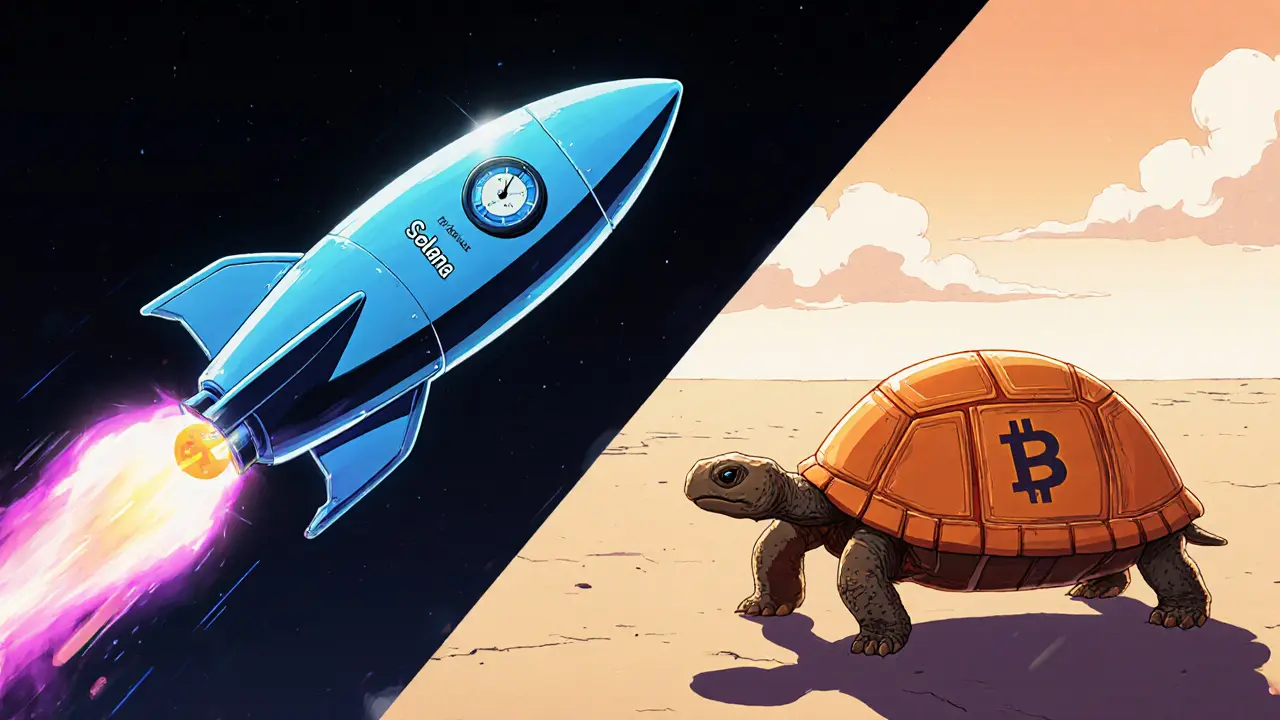

Did you know a Solana payment can be confirmed in under half a second while a Bitcoin transfer sits idle for ten minutes? That's the speed gap driving the race for the next‑generation crypto payment stack.

Quick Takeaways

- Solana’s average confirmation time is ~0.4seconds; Bitcoin’s is ~10minutes.

- Theoretical TPS: Solana65000, Avalanche4500, Bitcoin5‑7.

- Real‑world 2025 peaks are far lower: Solana reached 1504 TPS, about 1.6% of its theoretical max.

- Layer‑2 solutions like Polygon push Ethereum‑compatible speeds to ~7000 TPS.

- Speed alone isn’t enough-reliability, fees, and ecosystem support matter just as much.

What is Cryptocurrency transaction speed?

In the crypto world, speed is measured by two numbers:

- Transactions per second (TPS) - how many transfers the network can process in a single second.

- Confirmation time - the wait until a transaction is considered final.

Both metrics matter for payments. A high TPS means a network can handle many users at once, while a low confirmation time gives shoppers the instant‑checkout experience they expect from credit cards.

Why Speed Matters for Payments

When you pay with crypto, you’re not just moving value; you’re also signalling trust. Faster confirmations reduce the risk of double‑spends and improve merchant confidence. In 2025, retailers that accept Solana or Polygon report conversion rates 12% higher than those stuck with Bitcoin’s 10‑minute delays.

Technical Drivers Behind Speed

Every blockchain’s speed stems from its consensus engine and architecture. Here are the big players:

- Proof of History (PoH) + Proof of Stake (PoS) - used by Solana, squeezes many transactions into a single block.

- Pure PoS - Algorand’s approach, offering predictable 4.5‑second finality.

- Avalanche Consensus - a multi‑subnet protocol that finalises in under 2seconds.

- Layer‑2 rollups - Polygon bundles many Ethereum transactions off‑chain, then posts a single proof.

- Proof of Work (PoW) - Bitcoin’s energy‑heavy model, limiting block creation to about every 10minutes.

2025 Real‑World Performance Snapshot

| Blockchain | Theoretical TPS | Peak Daily TPS (2025) | Avg. Confirmation | Consensus |

|---|---|---|---|---|

| Solana | 65000 | 1504 | ~0.4seconds | PoH + PoS |

| Avalanche | 4500 | 2800 | ~2seconds | Avalanche Consensus |

| Algorand | 1000 | 950 | ~4.5seconds | Pure PoS |

| Polygon | 7000 (Layer‑2) | 5200 | ~1second | zk‑Rollup / Optimistic |

| Ethereum | 25 | 22 | ~12seconds | PoS (post‑Merge) |

| Bitcoin | 5‑7 | 6 | ~10minutes | PoW |

Pros & Cons of the Top Payment Chains

Solana

Speed champion - sub‑second finality makes it perfect for micro‑payments and gaming. However, its rapid growth has led to occasional network congestion, and the developer stack relies heavily on Rust, which can steepen the learning curve.

Avalanche

Balances speed (2‑second finality) with strong cross‑chain bridges. The downside? Smaller validator set means less decentralisation than Bitcoin or Ethereum.

Algorand

Consistent 4.5‑second confirmations and low fees suit cross‑border remittances. It lacks the massive DeFi ecosystem that Ethereum enjoys.

Polygon

Provides Ethereum‑compatible speed without leaving the familiar Solidity tooling. Watch out for rollup security assumptions - a bug in the rollup contract can affect many assets at once.

Ethereum

Huge developer community and mature tooling. Still, 12‑second block times feel sluggish for retail payments, pushing merchants toward Layer‑2s.

Bitcoin

Unmatched security and liquidity - the go‑to for high‑value settlements. The 10‑minute confirmation window makes it unsuitable for instant checkout.

Choosing the Right Crypto for Your Payment App

Ask yourself these questions before you lock in a network:

- Do I need sub‑second confirmation for a gaming micro‑payment or is a few‑seconds latency acceptable?

- What is my tolerance for transaction fees during peak traffic?

- Do I have in‑house expertise for Rust (Solana) or can I stick with Solidity (Polygon/Ethereum)?

- How important is network security versus speed for my use case?

Based on typical merchant priorities, here’s a quick decision matrix:

| Priority | Best Fit |

|---|---|

| Instant checkout (<1s) | Solana or Polygon (Layer‑2) |

| Cross‑border with low fees | Algorand or Avalanche |

| Maximum security, high value | Bitcoin |

| Established DeFi ecosystem | Ethereum + Polygon |

Common Pitfalls & How to Troubleshoot

Even fast chains stumble. Here are the top three issues and quick fixes:

- Network congestion spikes. Solution: Implement dynamic fee estimation and fall back to a secondary chain if confirmations exceed your SLA.

- Inconsistent finality guarantees. Solution: Wait for an extra block on Solana during high‑traffic periods to ensure true finality.

- Developer tooling gaps. Solution: Leverage community SDKs (e.g., Solana Web3.js, Polygon SDK) and keep an eye on official GitHub repos for updates.

Future Outlook

By 2027, analysts expect Layer‑2 solutions to push Ethereum’s effective TPS into the thousands, while high‑speed chains will aim to close the gap between theoretical and real‑world performance. Expect hybrid consensus models that blend PoS with sharding, giving merchants the best of both worlds - speed and security.

Frequently Asked Questions

What is the difference between TPS and confirmation time?

TPS measures how many transactions a network can process each second, while confirmation time tells you how long a single transaction takes to become final. A blockchain can have high TPS but still exhibit slower confirmations if it batches blocks.

Why does Solana’s real‑world TPS lag far behind its theoretical 65000?

The theoretical number assumes a perfectly balanced network with no congestion. In practice, validator capacity, network latency, and spikes in demand (like the 2025 memecoin surge) keep actual throughput around 1‑2% of that ceiling.

Are Layer‑2 solutions as secure as their base chains?

Layer‑2s inherit security from the base chain, but they add a trust layer in the rollup contract. Audits and proper fraud proofs are essential to maintain security parity.

Which crypto should I pick for a global retail checkout?

For sub‑second checkout and low fees, a hybrid approach works best: use Polygon for most purchases and fall back to Bitcoin for high‑value settlements where security trumps speed.

How do transaction fees relate to speed?

Higher fees usually prioritize a transaction in the mempool, speeding up confirmation. On fast networks like Solana, fees stay low even during congestion, but on Ethereum they can spike dramatically, forcing merchants to choose Layer‑2s for cost‑effective speed.