Law No. 7518 Turkey – Crypto Regulation Overview

When you hear Law No. 7518 Turkeythe legal framework that defines how crypto assets are treated in Turkey, covering licensing, AML rules, and tax obligations, you know you’re dealing with the official rulebook for digital money in the country. Law No. 7518 Turkey was introduced to bring clarity to a market that grew faster than the regulators could follow. It tells a crypto exchange whether it can operate, what paperwork it must file, and how the tax office will look at gains. In plain terms, if you trade Bitcoin on a platform that follows this law, you’re less likely to face a surprise fine or a frozen account.

Key Areas Covered by Law No. 7518

The law sits at the intersection of three core concepts. First, cryptocurrency regulationrules that govern the creation, trading, and reporting of digital assets sets the overall tone – it says that crypto is a recognized asset class and must be supervised. Second, exchange licensingthe process by which a trading platform obtains official permission to operate in Turkey is the concrete step exchanges take to comply. Third, AML complianceprocedures that prevent money‑laundering and terrorist financing through crypto transactions ensures that every trade can be traced back to a real identity. Together they form a semantic triple: Law No. 7518 Turkey encompasses cryptocurrency regulation; cryptocurrency regulation requires exchange licensing; AML compliance influences tax treatment. This chain explains why every article on our site that talks about an exchange, a token, or a risk factor inevitably circles back to the law.

Our collection of posts reflects exactly those connections. You’ll find a detailed review of EXMO vs BitoPro that explains how each platform meets licensing standards, a deep‑dive into the Chuck (CHUCK) token that highlights tax implications for Turkish holders, and a risk guide for Bangladesh citizens that mirrors the AML and legal hurdles laid out in Law No. 7518. The on‑chain analytics outlook, the future of transaction finality, and the multi‑chain DEX reviews all touch on compliance themes – whether it’s about proving asset provenance or meeting reporting duties. By reading through the articles below, you’ll get a practical sense of how the law shapes real‑world decisions: which exchange to trust, how to report your gains, and what red flags to watch for in a volatile market. Let’s jump into the content and see how each piece aligns with the regulatory landscape.

-

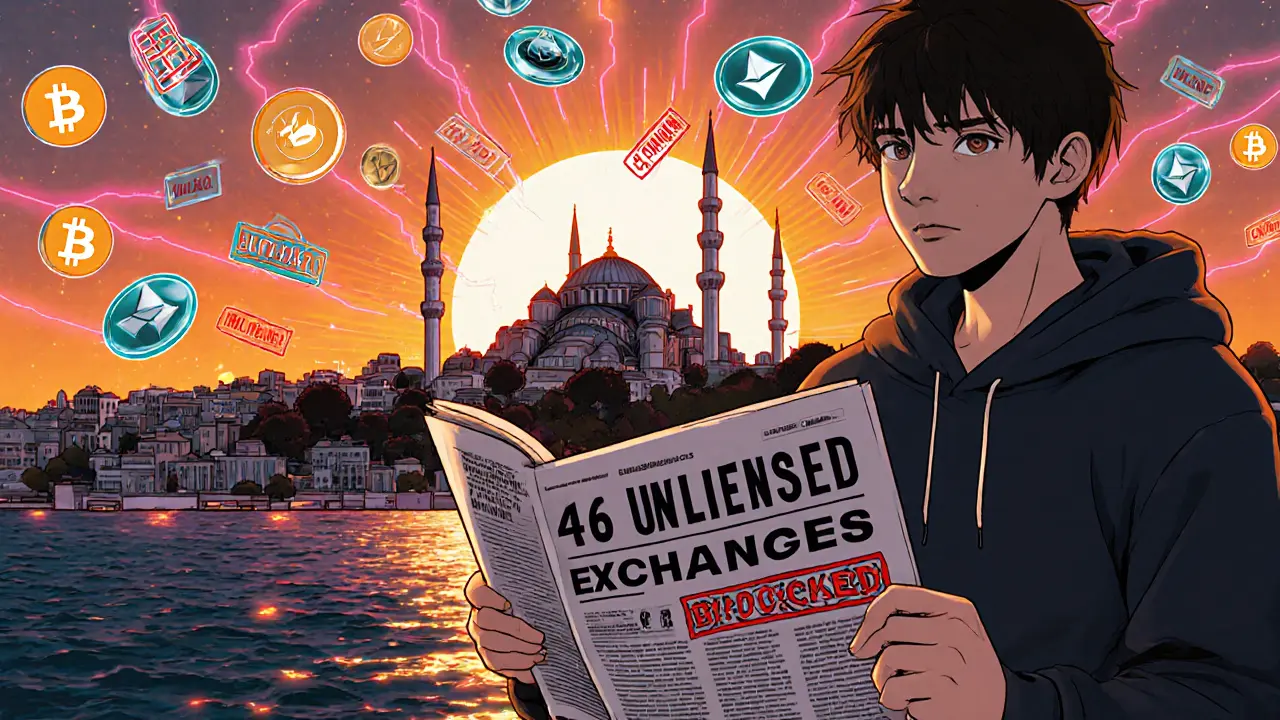

Turkey’s Crypto Regulation Overhaul: From Payment Ban to Full‑Scale Framework

Explore how Turkey transformed its crypto market from a permissive landscape to a strict licensing regime, the key law behind it, and what it means for exchanges, users and future regulation.