Diversification in Crypto: How to Spread Your Risk and Maximize Returns

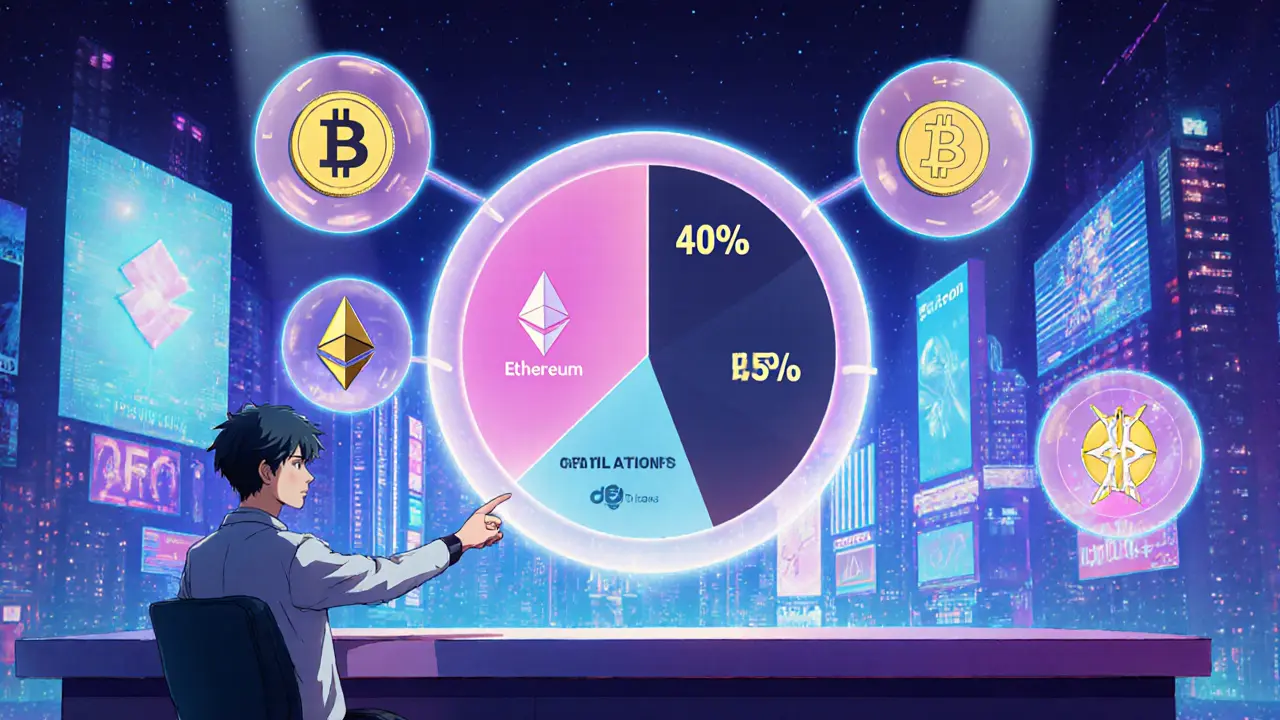

When talking about Diversification, the practice of spreading investments across different assets, platforms, and strategies to lower risk and improve potential gains. Also known as risk spreading, it helps protect your capital when markets turn volatile. Diversification isn’t just a buzzword; it’s a core principle that ties together Portfolio Allocation, how you divide funds among coins, tokens, and other crypto instruments and Risk Management, the methods you use to limit downside exposure. By understanding how these pieces fit, you can build a setup that stays steady through bull runs and bear dips.

Why Diversification Matters in Crypto

Crypto markets are notorious for sudden swings, and relying on a single asset can leave you exposed. Using multiple Crypto Exchanges, different platforms where you trade, store, or earn tokens spreads operational risk – if one exchange faces a hack or downtime, you still have access to your funds elsewhere. Pair this with a mix of high‑cap coins, promising low‑cap projects, and stablecoins, and you create a safety net that balances growth potential with stability. The concept also aligns with on‑chain analytics tools that highlight which assets move together, letting you avoid hidden correlations that could amplify losses.

Beyond exchanges, the types of tokens you hold play a big role. Stablecoins offer a low‑volatility anchor, while meme coins or niche utility tokens add upside potential. Including assets like Wrapped Bitcoin or tokenized DeFi positions diversifies not just by market cap but by underlying technology and use case. This variety mirrors traditional finance’s approach of mixing stocks, bonds, and commodities, but with the added twist of decentralized finance opportunities such as yield farming and staking.

Understanding Market Cycles, the repeating phases of bullish and bearish sentiment in crypto is essential for timing your diversification moves. During a bull market, allocating a bigger slice to growth‑focused tokens can capture upside, while in a bear phase, shifting toward stablecoins or less volatile assets helps preserve capital. Strategic rebalancing—periodically adjusting your holdings to match your target allocation—keeps your portfolio aligned with your risk tolerance and market outlook.

All these pieces—portfolio allocation, exchange selection, token variety, and market‑cycle awareness—form a cohesive diversification strategy. Below you’ll find a curated list of articles that dive deeper into each area: exchange reviews that help you pick safe platforms, token guides that break down risk profiles, and market‑analysis pieces that show how cycles affect your holdings. Use these resources to fine‑tune your approach and stay ahead of the curve.

-

Diversify Your Crypto Portfolio: Risk Management Strategies

Learn how to manage crypto risk by diversifying assets, geography, and income streams. Practical steps, tools, and a comparison table help you build a resilient portfolio.