When navigating the crypto market, Diversification is the practice of spreading assets across different coins, token types, platforms, and geographic nodes to lower exposure to any single failure point. In a world where a single smart‑contract bug or regulatory shock can wipe out a whole holding, spreading the risk isn’t just clever-it’s essential.

Why Diversification Beats Concentration in Crypto

Crypto assets behave unlike traditional stocks. While Bitcoin’s price often mirrors macro‑economic sentiment, a lesser‑known meme token may swing on community hype, and a DeFi token can tumble after a protocol hack. Because these drivers differ, the returns of each asset have low or even negative correlation. When one asset falls, another can hold steady or rise, smoothing the overall portfolio’s performance.

Research from the Canadian Institute of Actuaries shows that a well‑diversified mix of low‑correlated assets can cut total portfolio risk by up to 30% while preserving upside potential. In plain terms, diversification helps you avoid the "all‑eggs‑in‑one‑basket" nightmare that haunts many new crypto investors.

Core Pillars of Effective Crypto Diversification

- Asset Allocation: Split capital among major categories - Bitcoin (store of value), Ethereum (smart‑contract platform), Layer‑2 solutions, stablecoins, and emerging sectors like NFTs or Web3 infrastructure.

- Geographic Diversification: Invest in projects hosted on nodes in different jurisdictions (e.g., North America, Europe, Asia) to buffer against regional regulatory crackdowns.

- Product & Service Diversification: Combine speculative tokens with income‑generating assets such as staking, yield‑farm farms, or tokenized real‑estate.

- Supplier (Exchange) Diversification: Keep funds on several reputable exchanges and hardware wallets to reduce the risk of a single platform failure.

- Operational Diversification: For crypto‑focused businesses, diversify revenue streams-trading fees, consulting, NFT marketplace royalties, and blockchain‑as‑a‑service contracts.

Understanding Correlation - The Math Behind the Mix

Correlation measures how two assets move together. A value of +1 means they rise and fall in lockstep; 0 means no relationship; -1 means they move opposite each other. In crypto, Bitcoin and Ethereum often show a modest positive correlation (~0.6), while Bitcoin and a stablecoin hover near 0, and Bitcoin versus a utility token from a niche blockchain can even be slightly negative.

Tools like Coin Metrics, Glassnode, or the open‑source pandas library let you calculate rolling correlation coefficients. Aim to build a basket where the average pairwise correlation stays below 0.4. The lower the correlation, the greater the risk‑reduction benefit.

Step‑by‑Step Guide to Building a Diversified Crypto Portfolio

- Assess Current Exposure: List every holding, its dollar value, and its primary risk driver (regulatory, technical, market sentiment).

- Identify Gaps: Spot over‑weight positions (>30% of total) and under‑represented categories (e.g., no exposure to stablecoins or non‑Ethereum Layer‑2s).

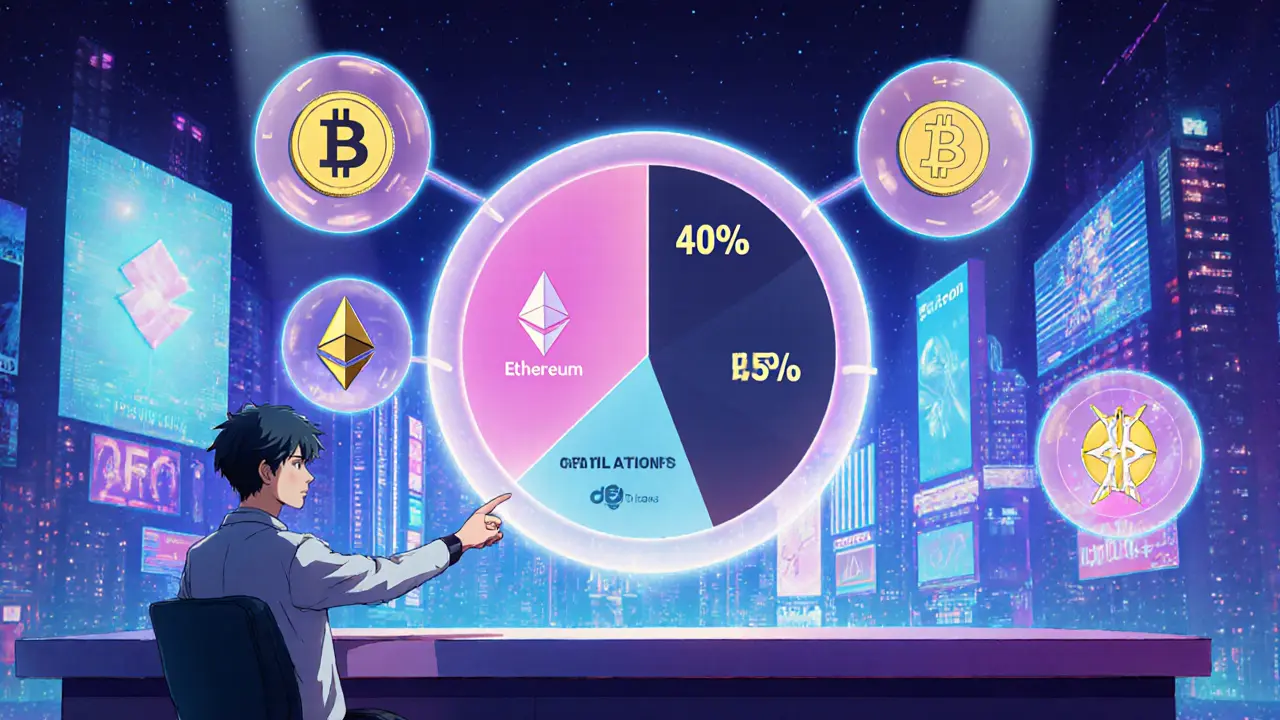

- Set Allocation Targets: Use a simple rule‑of‑thumb-40% Bitcoin, 30% Ethereum, 15% diversified altcoins, 10% stablecoins, 5% alternative assets (e.g., tokenized real estate or commodities).

- Choose Low‑Correlation Picks: Run a correlation matrix and select assets that sit on different rows of the matrix.

- Implement with Multiple Custodians: Split the allocations across a hardware wallet, a decentralized exchange, and a regulated custodial platform.

- Monitor & Rebalance Quarterly: Adjust allocations if any asset’s weight drifts beyond ±5% or if correlation patterns shift.

Typical learners take 6‑12 months to become comfortable reading correlation charts and 2‑3 years for institutions to embed automated rebalancing tools.

Side‑by‑Side Comparison: Diversified vs. Concentrated Crypto Portfolios

| Metric | Diversified (5‑Asset Mix) | Concentrated (2‑Asset Mix) |

|---|---|---|

| Average Annual Return (2022‑2024) | 12.4 % | 9.7 % |

| Standard Deviation (Volatility) | 28 % | 42 % |

| Maximum Drawdown | ‑35 % | ‑60 % |

| Sharpe Ratio (Risk‑Adjusted Return) | 0.45 | 0.22 |

| Correlation Avg. (within portfolio) | 0.32 | 0.78 |

The numbers speak for themselves: a diversified mix not only tames volatility but also nudges the upside higher thanks to exposure to assets that perform well when Bitcoin stalls.

Advanced Diversification: Alternatives, ESG, and DeFi

Beyond the usual coins, the crypto universe now offers real‑world assets tokenized on‑chain. Think fractional ownership of office buildings, gold‑backed stablecoins, or carbon‑credit tokens. Adding even a modest 5% allocation to these alternatives can further lower correlation because their price drivers differ from pure crypto market sentiment.

Environmental, Social, and Governance (ESG) criteria are also entering crypto diversification. Funds that filter for low‑energy‑consumption proof‑of‑stake networks or projects with transparent governance add a non‑financial risk hedge-regulatory pressure on high‑energy proof‑of‑work chains could hurt those assets, while ESG‑aligned tokens may benefit from favorable policy.

DeFi protocols provide yield‑generation tools (staking, liquidity mining). Using a portion of your portfolio for low‑risk, audited DeFi services spreads risk across both price appreciation and income streams.

Common Pitfalls and How to Avoid Them

- Over‑Diversifying: Adding too many low‑liquidity tokens can trap capital. Stick to assets with decent daily volume (>$10 M) unless you have a specific thesis.

- Ignoring Correlation Shifts: During market crises, historically uncorrelated assets can start moving together. Re‑run correlation analysis after any major shock.

- Neglecting Custody Security: Spreading across exchanges helps diversification, but each new custodian introduces its own hack risk. Use hardware wallets for the bulk of long‑term holdings.

- Forgetting Tax Implications: Swapping to rebalance generates taxable events in many jurisdictions. Plan rebalancing around low‑tax periods or use “tax‑loss harvesting” strategies.

Key Takeaways

- Diversification cuts risk by lowering the average correlation among holdings.

- Effective diversification mixes asset classes, geographies, and income‑generating products.

- Use quantitative correlation tools to select truly low‑correlated assets.

- Rebalance regularly and stay vigilant for correlation spikes during crises.

- Consider alternatives, ESG tokens, and DeFi yields to broaden the risk‑mitigation net.

How many different crypto assets should a beginner hold?

A solid starting point is 5‑7 assets across major categories: Bitcoin, Ethereum, a stablecoin, a high‑growth altcoin, and a low‑correlation sector token (e.g., a DeFi or NFT platform). This spread offers risk reduction without overwhelming complexity.

Do stablecoins count as diversification?

Yes. Stablecoins have near‑zero price correlation with volatile cryptocurrencies, acting as a cash‑like buffer that reduces overall portfolio volatility.

What tools can I use to calculate crypto correlation?

Free options include Coin Metrics’ correlation explorer, Glassnode’s metrics dashboard, or building a custom spreadsheet with historical price data and the Pearson correlation formula.

How often should I rebalance my crypto portfolio?

Quarterly reviews work for most investors. If a major market event occurs, run an ad‑hoc check to ensure correlation hasn’t spiked.

Can diversification eliminate all crypto losses?

No. It reduces exposure but cannot protect against systemic crashes, smart‑contract bugs, or regulatory bans that affect the whole sector.