Crypto Payment TPS: Understanding Speed, Scalability, and Real‑World Use

When talking about crypto payment TPS, the number of transactions a blockchain can settle each second for payment‑focused use cases. Also known as transaction throughput, it directly shapes how fast users can move value. Blockchain scalability, the ability of a network to handle growing demand without sacrificing performance is the broad challenge behind TPS. Layer‑2 solutions, off‑chain or sidechain mechanisms that batch and settle transactions faster offer a shortcut, while Consensus mechanisms, the rules nodes follow to agree on new blocks determine the theoretical ceiling. Finally, Transaction finality, the point at which a transaction becomes irreversible balances speed with security. Together these concepts shape the payment experience on any crypto network.

Key Factors That Drive Crypto Payment TPS

Why does TPS matter for payments? Imagine trying to buy a coffee with a blockchain that only confirms one transaction every ten minutes – the line would never end. High TPS keeps friction low, letting merchants accept crypto just like credit cards. Most of that speed comes from layer‑2 solutions such as rollups or state channels, which compress many user actions into a single on‑chain proof. At the same time, the underlying consensus – proof‑of‑work, proof‑of‑stake, or newer hybrid models – sets the baseline that layer‑2 builds upon. If the base chain finalizes blocks quickly, the rollup can batch more transactions, pushing overall TPS higher.

Security and finality often get tangled with speed. A network might claim 10,000 TPS, but if finality takes several minutes, merchants still face settlement risk. Protocols like Tendermint achieve sub‑second finality by using a Byzantine‑fault‑tolerant consensus, yet they may limit decentralization. Meanwhile, larger proof‑of‑stake chains trade a bit of finality latency for broader validator participation. Understanding these trade‑offs helps you pick a network that fits your risk appetite while still delivering the speed you need.

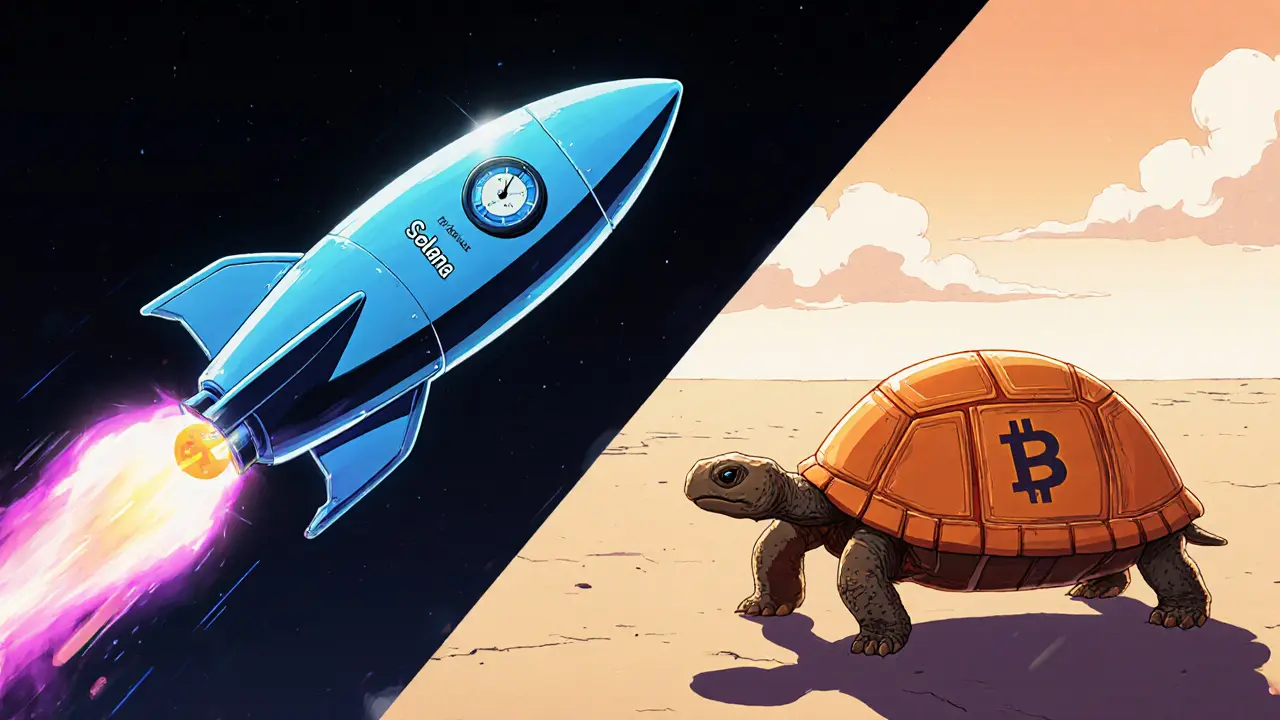

People often compare Bitcoin’s 4‑7 TPS to Solana’s advertised 65,000 TPS and assume the latter is always better for payments. The reality is messier. Bitcoin prioritizes security and decentralization, which keeps its finality robust but slow. Solana’s high TPS stems from a heavy reliance on a single leader‑schedule and low‑latency networking, making it fast but sometimes prone to outages. When you evaluate a blockchain for payments, look beyond headline numbers and ask: “What’s the real‑world average TPS under load? How often does the network experience downtime?” Those answers reveal whether the speed is reliable for everyday transactions.

Measuring TPS isn’t just about counting transactions on a testnet. Real‑world TPS considers network congestion, gas fees, and the size of each transaction. For payment‑heavy use cases, many chains use standardized, small‑payload transfers that boost effective TPS. Tools like on‑chain analytics dashboards can show you peak versus median TPS, helping you decide if a network can handle your sales volume during rush hours. A practical rule of thumb: aim for a network whose median TPS is at least twice your expected peak transaction rate.

Looking ahead, several trends promise to push crypto payment TPS even higher. Sharding splits a blockchain into multiple parallel chains, each processing its own transactions, effectively multiplying throughput. Hybrid consensus models combine proof‑of‑stake security with fast finality layers, giving the best of both worlds. Additionally, advances in zero‑knowledge rollups are reducing the data each transaction needs to submit, squeezing more payments into each batch. Keeping an eye on these developments ensures you stay ready for the next speed jump.

If you’re ready to adopt a high‑TPS payment solution, start by mapping your transaction volume and latency tolerance. Test a few layer‑2 options on a sandbox environment to see how they handle batch sizes and fee structures. Also, check the community’s track record for handling upgrades and outages – a fast network that’s frequently down won’t serve your business. Finally, balance cost: some high‑TPS chains charge higher fees per transaction, so factor that into your pricing model.

Below you’ll find a curated set of articles that dive deeper into each of these topics – from detailed reviews of exchanges that support fast payments to guides on choosing the right layer‑2 for your needs. Grab the insights that match your situation and start building a payment flow that moves at the speed of your customers.

-

Crypto Payment Transaction Speed Comparison 2025: TPS & Confirmation Times

Compare cryptocurrency payment speeds in 2025: TPS, confirmation times, pros, cons, and which chain fits your checkout needs.