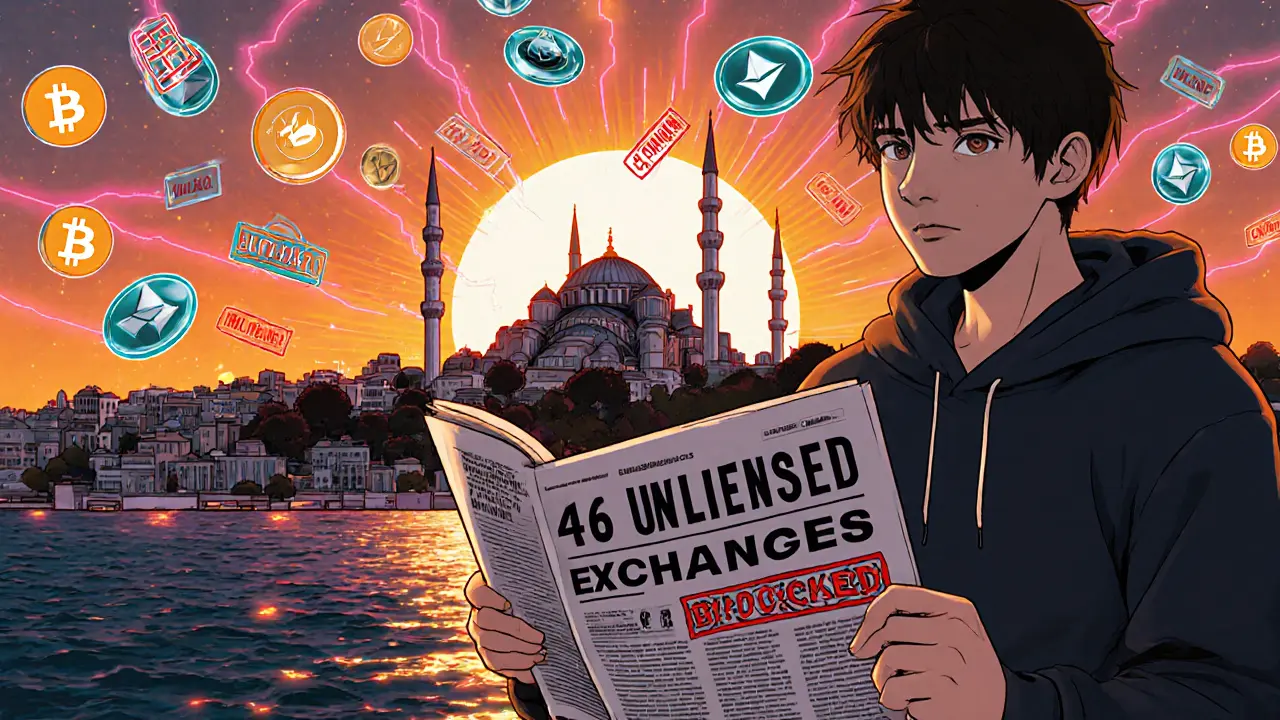

Crypto Exchange Ban Turkey – Impact, Workarounds & What’s Next

When dealing with crypto exchange ban Turkey, the official prohibition that blocks Turkish residents from accessing most foreign crypto platforms. Also known as Turkey crypto ban, it shifts how locals buy, sell, and move digital assets. The ban is enforced by Banking Regulation and Supervision Agency (BRSA), the authority that issued the 2021 directive limiting fiat‑to‑crypto conversions. This regulatory move created a ripple effect: exchanges had to lock out Turkish IPs, users faced frozen accounts, and the market saw a sudden dip in trading volume. At the same time, traders started looking for technical workarounds, prompting a surge in VPN detection, geofencing technologies that spot and block VPN traffic on platforms like Bybit and Binance. Understanding these pieces helps you see why the ban matters beyond a simple headline.

How the Ban Shapes Choices for Turkish Traders

The ban’s core idea is simple: regulation limits access. But the reality branches out. First, alternative crypto exchanges, services that either comply with Turkish law or operate in a gray zone have become the go‑to options. Some local platforms, like BtcTurk, stay fully compliant and keep KYC processes tight, while others skirt the rules by offering peer‑to‑peer swaps. Second, the rise of geofencing, network filters that block traffic from prohibited regions forces traders to test VPNs, but many exchanges now employ AI‑driven detection that flags suspicious IP patterns. Third, the ban pushes investors toward decentralized exchanges (DEXes) on networks such as Ethereum or Cardano, where no central authority can block access outright. However, DEX use brings its own risks: smart‑contract bugs, higher gas fees, and the need for self‑custody knowledge. Finally, the regulatory climate influences tax reporting; the BRSA now expects crypto gains to be declared, aligning with broader Turkish financial oversight.

All these factors—regulatory pressure, tech safeguards, compliance routes, and tax expectations—create a complex landscape for anyone looking to trade from Turkey. Below you’ll find a curated set of articles that break down exchange reviews, VPN workarounds, regional restrictions, and practical steps you can take today. Dive in to see how each piece fits into the bigger picture and what actions you can start taking right now.

-

Turkey’s Crypto Regulation Overhaul: From Payment Ban to Full‑Scale Framework

Explore how Turkey transformed its crypto market from a permissive landscape to a strict licensing regime, the key law behind it, and what it means for exchanges, users and future regulation.