Blockchain Scaling: How Networks Handle More Users Without Slowing Down

When you send Bitcoin or Ethereum, it doesn’t just vanish into the air—it gets recorded on a public ledger called the blockchain, a distributed, tamper-proof digital ledger that stores every transaction across thousands of computers. Also known as distributed ledger technology, it’s what makes crypto trustless and censorship-resistant. But here’s the problem: as more people join, the network gets crowded. Transactions take minutes instead of seconds. Fees spike to $50 or more. That’s not scaling—it’s choking.

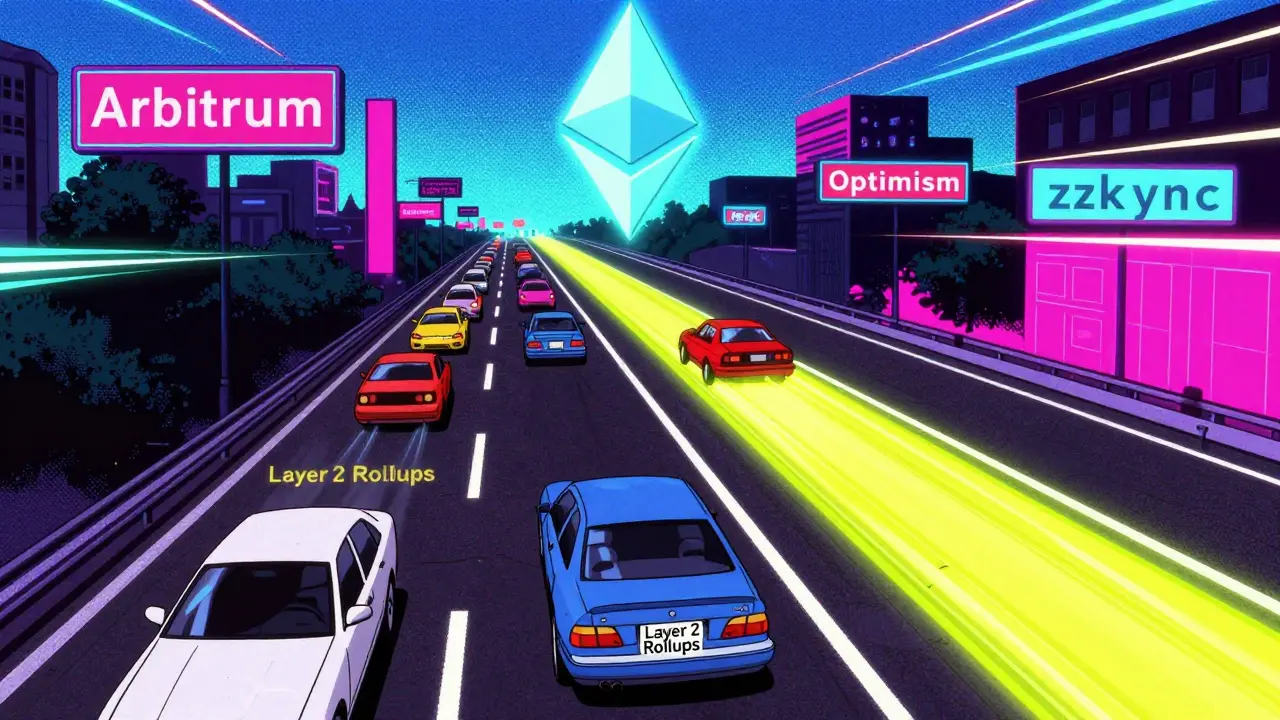

That’s where blockchain scaling, the process of increasing how many transactions a network can handle per second without sacrificing security or decentralization comes in. Think of it like upgrading a highway from two lanes to ten. You can’t just add more cars to the same road and expect smooth traffic. You need better design. That’s why projects like Layer 2 solutions, systems built on top of main blockchains to process transactions faster and cheaper exist. They handle the heavy lifting off-chain, then bundle results back to the main chain. Polygon, Arbitrum, and Optimism are all Layer 2s that cut Ethereum fees by 90%+ and speed up trades to near-instant. Meanwhile, transaction fees, the cost users pay to get their transactions confirmed on a blockchain are the canary in the coal mine—if they’re rising, the network is overloaded. And you’ve seen it: gas wars on Ethereum, users abandoning DeFi, or switching to Solana or BSC just to get trades done. That’s why scaling isn’t just tech talk—it’s survival.

But scaling isn’t just about speed. It’s about access. Look at Iran, where people use DEXs like DAI on Polygon to bypass banking blocks. Or Russia, where users trade crypto with rubles because traditional systems won’t help. These aren’t edge cases—they’re signals. When a network can’t scale, it excludes people. The posts below cover exactly that: how exchanges like B2Z and Interdax cater to traders who need fast, low-fee, private transactions. How Layer 2s like Shibarium let WBONES tokens work smoothly. How IP tracking and geolocation make privacy harder when networks get crowded. And how fake airdrops and micro-cap scams thrive when users are desperate for opportunities on slow, expensive chains. You’ll find real-world fixes, not theory. Real platforms, real risks, real choices. This isn’t about what scaling could be. It’s about what it is—and who’s using it right now.

-

Sharding vs Layer 2 Solutions: Which Blockchain Scaling Method Wins?

Sharding and Layer 2 solutions are the two main ways blockchains scale. Layer 2s add speed on top of existing chains; sharding splits the chain itself. Learn which one fits your needs today and tomorrow.

-

Future of Blockchain Transaction Fees: How Costs Are Plunging and What It Means for You

Blockchain transaction fees have dropped from $24 to under a cent thanks to Layer-2 scaling and Solana’s efficiency. Stablecoins now move $1.25 trillion monthly with near-zero costs, transforming global payments.