Asset Allocation in Crypto: Strategies, Risks, and Tools

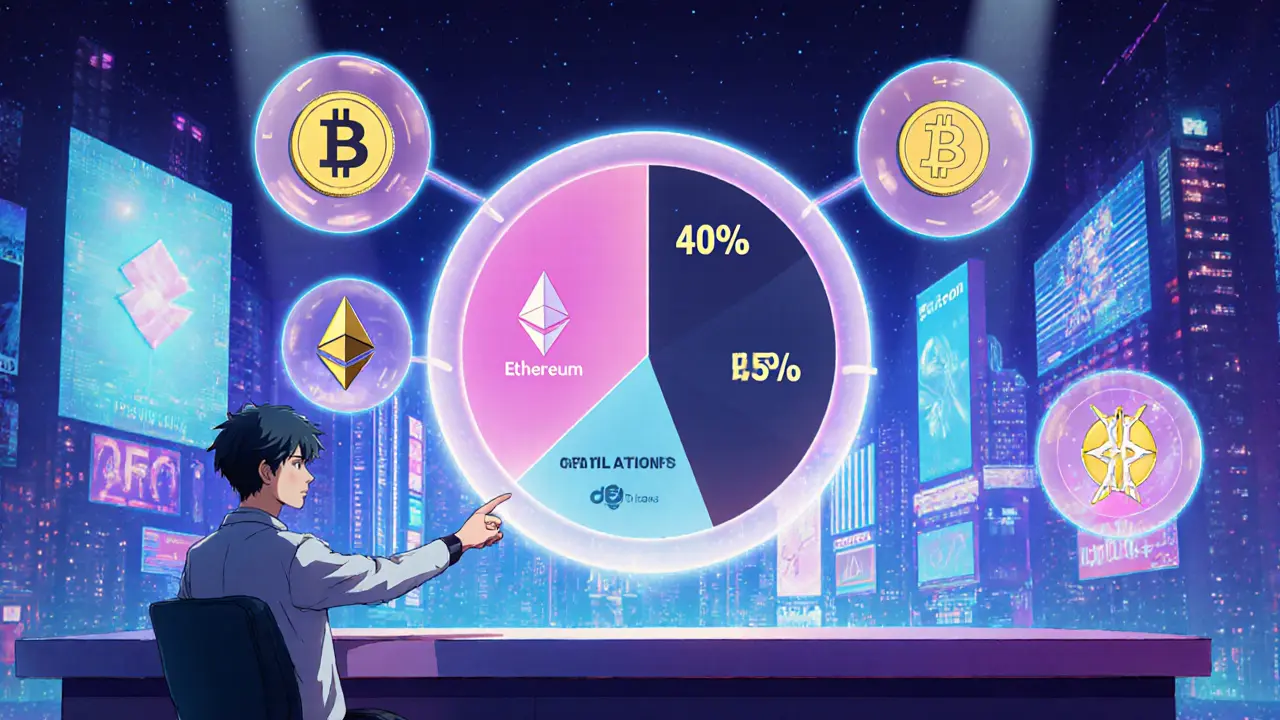

When talking about asset allocation, the process of spreading your crypto holdings across different assets to manage risk and pursue returns. Also known as portfolio diversification, it helps investors avoid putting all their eggs in one basket. A solid allocation plan leans on key data points such as circulating supply, the number of tokens actively traded in the market, which directly influences price dynamics and market cap and the broader market mood captured by bull & bear markets, periods of rising or falling prices that dictate risk appetite. Modern investors also tap into on-chain analytics, tools that monitor blockchain activity, transaction flows, and holder behavior to forecast trends. Combining these elements lets you build a resilient portfolio that can weather volatility while still capturing upside.

Key Factors to Consider

First, understand how circulating supply shapes your allocation decisions. Tokens with a low circulating supply but high demand can experience sharp price spikes, but they also carry liquidity risk. By contrast, high‑supply assets often provide steadier, though slower, growth. Next, gauge the current market phase. In a bull market, you might tilt toward growth‑oriented coins, whereas a bear market calls for defensive holdings like stablecoins or assets backed by real‑world value. On‑chain analytics sharpen this view by revealing where large wallets are moving funds, spotting potential accumulation or distribution patterns before price moves. Finally, factor in exchange safety and fees – the reviews of platforms like EXMO, Ionomy, or PowerTrade show how security and cost impact net returns, especially when you’re rebalancing across multiple assets.

Putting it all together, a robust crypto asset allocation strategy blends supply metrics, market cycle awareness, and data‑driven insights from on‑chain tools while keeping an eye on exchange reliability. The posts below dive deeper into each of these topics, from detailed exchange reviews to guides on circulating supply and market dynamics. Browse the collection to see how you can apply these concepts, refine your portfolio, and stay ahead of the curve in the fast‑moving crypto world.

-

Diversify Your Crypto Portfolio: Risk Management Strategies

Learn how to manage crypto risk by diversifying assets, geography, and income streams. Practical steps, tools, and a comparison table help you build a resilient portfolio.