DEX Transaction Cost Calculator

Calculate Your Transaction Costs

Find out how much you'll pay in transaction fees when using Ethereum vs Polygon for decentralized exchanges.

Important: Ethereum gas fees are currently over $10 per transaction, while Polygon fees are under $0.10. This calculator shows the cost difference to help you make informed decisions.

For many Iranians, accessing global financial systems isn’t just difficult-it’s often impossible. Banking restrictions, currency collapse, and international sanctions have pushed millions to turn to cryptocurrency as a lifeline. But when centralized exchanges like Nobitex get hacked or frozen by Tether, where do you turn? The answer increasingly lies in decentralized exchanges-but getting there isn’t simple.

Why Centralized Exchanges Are No Longer Safe

Nobitex used to be the go-to platform for Iranian crypto users. With over 11 million accounts, it handled more than 87% of all local crypto trades. But in June 2025, it got hacked. Over $90 million vanished. And it wasn’t just a random breach. Investigations showed connections between Nobitex wallets and IRGC-linked addresses, making it a target for global sanctions. Then came July 2025. Tether froze 42 Iranian-linked addresses-more than half tied to Nobitex. Suddenly, USDT, the stablecoin everyone relied on, became a liability. Holding it meant risking your entire balance. People scrambled. And they didn’t just sit around waiting for help-they moved.The Shift to DAI on Polygon

Within days of the Tether freezes, Iranian crypto communities began pushing one solution: swap USDT for DAI on the Polygon network. Why? Because DAI is decentralized. It’s not controlled by any company. And Polygon? It’s fast, cheap, and harder for sanctions enforcers to track than Ethereum. This wasn’t a lucky accident. It was a coordinated pivot. Crypto influencers, local traders, and even government-aligned channels pushed the switch. People learned how to use wallets like MetaMask, connect to DEXs like SushiSwap or QuickSwap, and swap tokens without a middleman. The result? A quiet but massive migration away from centralized control. You don’t need a bank account. You don’t need to verify your identity. You just need internet, a VPN, and a wallet.How DEXs Work Without a Central Authority

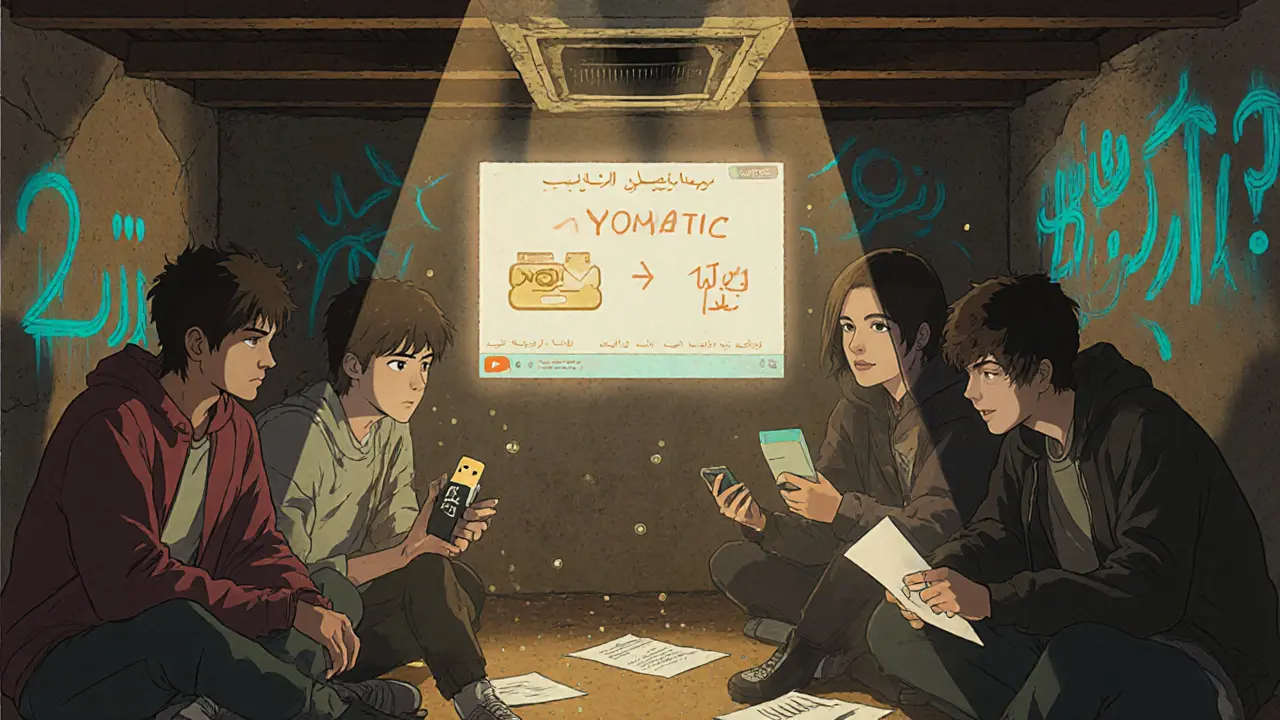

A decentralized exchange doesn’t hold your money. It doesn’t ask for your ID. It doesn’t freeze your funds. It’s just code running on a blockchain. When you trade on a DEX like Uniswap or SushiSwap, you’re swapping tokens directly with other users through smart contracts. Your wallet stays in your control. This is why DEXs are the only viable option for Iranians right now. Centralized platforms answer to governments and financial regulators. DEXs don’t answer to anyone. Even if Iran’s Central Bank demands all crypto data, it can’t get access to your wallet unless you give it the private key. The catch? You have to know how to use it. Setting up a wallet, buying ETH or MATIC, connecting to a DEX, and swapping tokens isn’t obvious if you’ve only ever used an app like Nobitex. But tutorials are everywhere. YouTube videos in Farsi. Telegram groups. Reddit threads. People are teaching each other.

What You Need to Get Started

Here’s what actually works for Iranians today:- A VPN-to bypass local internet blocks on crypto sites. NordVPN, ExpressVPN, and ProtonVPN are commonly used.

- A non-custodial wallet-MetaMask is the most popular. Trust Wallet and Phantom work too.

- Some MATIC or ETH-to pay for transaction fees. Buy these through peer-to-peer platforms like Paxful or LocalBitcoins, or through friends who have access.

- A DEX on Polygon-QuickSwap or SushiSwap are the most reliable. Avoid Ethereum-based DEXs-they’re too slow and expensive.

Iran’s Government Is Watching-But Can’t Stop It

In January 2025, Iran made it illegal to use cryptocurrency without a license from the Central Bank. Every user, every miner, every trader must register. The bank gets full access to your transaction history. Sounds scary? It is. But here’s the reality: the Central Bank can’t track DEX activity. Not really. If you use a DEX through a VPN and your wallet never connects to a licensed exchange, there’s no paper trail. No bank account. No KYC. No data to hand over. That’s why the government also cracked down on mining. In December 2024, rolling blackouts hit Tehran. Officials blamed illegal Bitcoin miners. They raided homes, seized rigs, and jailed people. But mining is still happening-underground, in basements, on solar panels. People are adapting. The same goes for DEX use. The law says it’s illegal. But enforcement? It’s nearly impossible. You can’t arrest a smart contract.

What About Taxes and Legal Risk?

In August 2025, Iran passed a new law: crypto profits are taxable. Like gold or real estate. If you make money trading, you owe the government. But here’s the twist: the government doesn’t know how much you made unless you tell them. Most Iranians using DEXs don’t report their gains. Why? Because reporting means admitting you’re using crypto-and opening yourself to scrutiny. So they trade quietly. They keep small amounts. They avoid large withdrawals. They treat crypto like cash: use it, don’t flaunt it. The risk isn’t zero. But it’s lower than keeping money in a bank that could collapse tomorrow.What’s Next for Iranian Crypto Users?

The future isn’t about bypassing sanctions. It’s about building alternatives. Iranian developers are already working on local DEXs that run on private blockchains. Some are experimenting with Iran’s own cross-border messaging system, CIMS, which connects to Chinese banks to move money outside the SWIFT system. Meanwhile, global DEXs keep improving. New interfaces are being translated into Farsi. Wallets are adding one-click swap features. The tools are getting easier. The most important thing? Iranian users aren’t waiting for permission. They’re learning, sharing, and adapting. They’ve turned a system designed to isolate them into a tool for freedom.Final Reality Check

Using a DEX won’t fix Iran’s economy. It won’t end sanctions. But for millions, it’s the only way to protect their savings, pay for imports, and send money to family abroad. It’s not a luxury. It’s survival. If you’re an Iranian citizen reading this, you already know the risks. But you also know what happens when you do nothing. The choice isn’t between safe and risky. It’s between trapped and free. Start small. Learn one thing today. Maybe set up a MetaMask wallet. Maybe buy $10 worth of MATIC from a trusted friend. Maybe swap your USDT for DAI. You don’t need to do it all at once. Just start. The system wants you to believe you have no options. But you do. You always have.Can I use a DEX in Iran without a VPN?

Technically, yes-but you won’t be able to access most DEX websites. Iran blocks many crypto platforms, including MetaMask’s official site and Uniswap. A VPN is the only reliable way to bypass these blocks. Free VPNs often don’t work well with crypto wallets due to IP detection. Paid services like NordVPN or ExpressVPN are recommended.

Is DAI safer than USDT in Iran right now?

Yes. After Tether froze over 40 Iranian-linked addresses in July 2025, DAI became the preferred stablecoin. Unlike USDT, DAI is fully decentralized and not controlled by any company that can be pressured by U.S. regulators. DAI on Polygon is fast, cheap, and has proven resilient to freezes. Most Iranian traders now use DAI as their primary stablecoin.

Can the Iranian government freeze my DEX wallet?

No. DEX wallets are non-custodial, meaning only you control the private keys. The government can’t freeze your wallet unless you give them access. However, if you bought crypto through a licensed Iranian exchange like Nobitex, your transaction history is already recorded. To stay safe, avoid linking your DEX wallet to any regulated platform.

What’s the cheapest way to buy crypto for a DEX in Iran?

Peer-to-peer (P2P) platforms like Paxful or LocalBitcoins are the most common. You can buy ETH or MATIC directly from other users using bank transfers or even cash. Some Iranians use trusted friends or family abroad to send crypto. Avoid buying through Iranian exchanges-those are monitored and risky after the Nobitex hack.

Why use Polygon instead of Ethereum for DEXs in Iran?

Ethereum transaction fees (gas) are often over $10, which is too expensive for most Iranians. Polygon offers the same security as Ethereum but with fees under $0.10. It’s faster, cheaper, and has growing DEX support like QuickSwap and SushiSwap. Most Iranian traders now use Polygon specifically because it’s affordable and hard to block.

Is it legal to use a DEX in Iran?

According to Iran’s Central Bank regulations from January 2025, all cryptocurrency activity requires a license. Using a DEX without one is technically illegal. However, enforcement is nearly impossible because DEXs don’t collect user data. The government can punish people who use licensed exchanges or mine crypto illegally-but tracking anonymous DEX trades is not feasible with current technology.

What happens if I get caught using a DEX?

There are no known cases of individuals being punished solely for using a DEX. The government has targeted miners, licensed exchange operators, and those involved in large-scale money laundering. If you’re trading small amounts privately and not advertising your activity, your risk is very low. The bigger danger is using a centralized exchange that’s been compromised or monitored.