Crypto vs. Traditional Transaction Calculator

Enter Your Transaction

Transaction Comparison

• Crypto: <0.5% fees, 10-15 minutes

• Traditional: Up to 5% fees, 3-5 business days

More than 20 million Russians - over one in seven adults - now hold or use cryptocurrency. That’s not a fringe trend. It’s a survival strategy. With Western payment systems like Visa, Mastercard, and SWIFT cut off after 2022, ordinary people, small businesses, and even large institutions turned to Bitcoin, Ethereum, and stablecoins to keep the economy moving. This isn’t about speculation. It’s about access - to goods, services, and the global financial system.

Why Russians Use Crypto

The main reason Russians turned to crypto isn’t excitement about blockchain tech. It’s necessity. After sanctions hit, Russian banks lost access to international payment networks. Importing software, paying freelancers abroad, buying medical equipment, or even ordering spare parts for factories became nearly impossible through traditional channels. Crypto filled the gap.One Moscow-based software developer told a local tech forum: "I used to pay my Ukrainian developers through PayPal. After February 2022, that vanished. Now I send USDT. It clears in 12 minutes. No middlemen. No fees over 0.3%." That’s typical. Cross-border crypto transactions take 10-15 minutes and cost under 0.5%. Traditional bank wires? Three to five business days, with fees up to 5%.

Stablecoins like USDT and USDC are especially popular because they hold value close to the U.S. dollar. With the ruble fluctuating due to inflation and capital controls, crypto became a digital savings account. People aren’t trying to get rich overnight. They’re trying to stop losing money.

What the Numbers Show

As of March 2025, Russian crypto users held a combined $10.15 billion in exchange wallets - up from $8 billion a year earlier. Bitcoin makes up 62% of those holdings. Ether is second at 22%. The rest? Mostly USDT and USDC. That’s not random. It’s strategic. Bitcoin is seen as digital gold. Ether is the backbone of smart contracts. Stablecoins are the everyday currency.Chainalysis ranked Russia #10 globally for crypto adoption in 2025. That’s impressive considering most Western exchanges like Coinbase and Binance are blocked. Russia doesn’t lead because of flashy DeFi apps - it’s ranked #52 in decentralized finance. It leads because of sheer volume of peer-to-peer trades and institutional use. In fact, Russia ranks #4 in institutional crypto adoption - higher than the UK, Germany, and Japan.

Statista predicts Russia’s crypto market will generate $2.3 billion in revenue in 2025. That’s up nearly 30% from 2024. Most of that comes from trading and wallet balances, not merchant payments. Because here’s the catch: you can own crypto in Russia. But you can’t use it to buy coffee, a phone, or a car.

The Legal Gray Zone

Russia’s 2021 law, "On Digital Financial Assets," says one thing clearly: cryptocurrency is not legal tender. You can hold it. You can trade it. But you can’t pay for goods or services with it. That’s a contradiction. Millions use it anyway - mostly through informal channels.Less than 0.5% of Russian businesses accept crypto as payment. Compare that to the global average of 3.5%. Why? Fear. A business that accepts Bitcoin for a product risks fines or being labeled a money launderer. Banks are cautious. The Central Bank of Russia doesn’t want to endorse something it can’t control.

But the government is shifting. In October 2025, Deputy Finance Minister Ivan Chebeskov said: "Crypto is not going away. We must address it to secure economic and technological benefits." That’s a major change from "crypto is a threat" to "crypto is a tool."

Now, the Bank of Russia is preparing to let commercial banks handle crypto transactions - but only under strict capital and reserve rules. That means Russian banks could soon offer crypto custody, trading, and even lending. It’s not legalization. It’s regulation with control.

How People Actually Use It

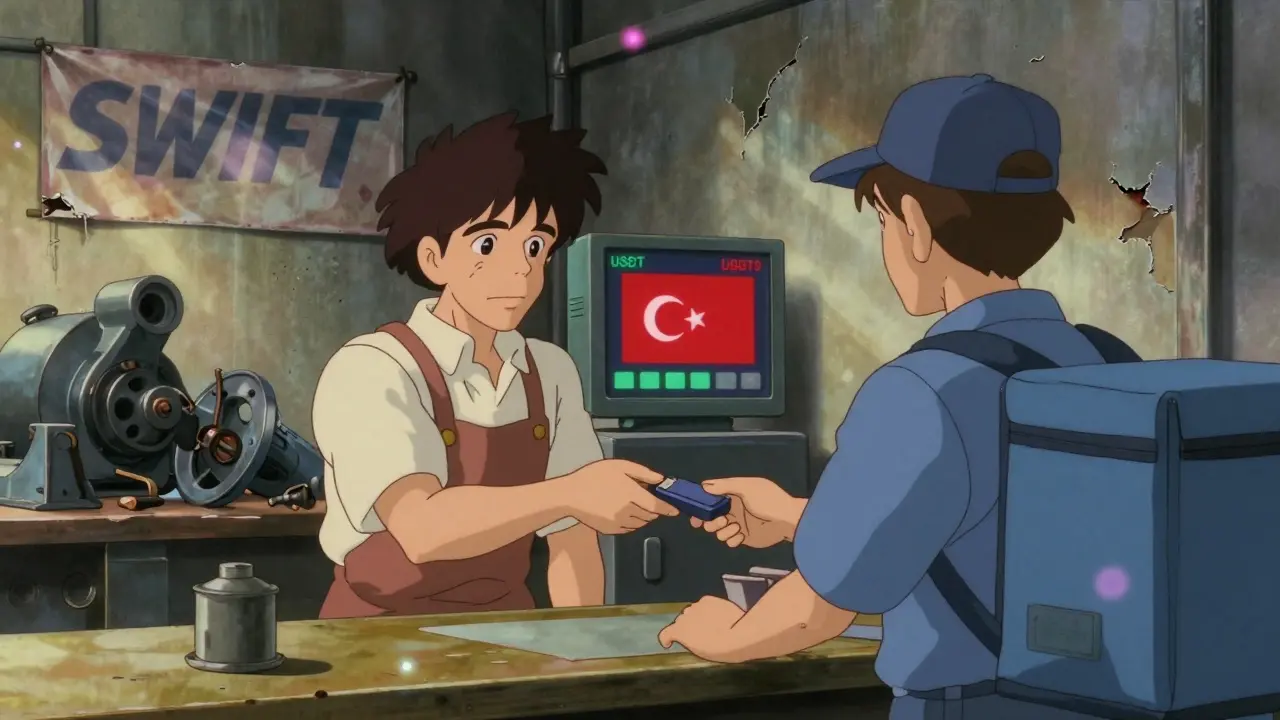

Most Russians don’t use apps like MetaMask or Uniswap. They use local platforms like EXMO, BitPrepay, and Kuna.io. These are peer-to-peer marketplaces where users trade rubles for crypto directly with each other. No bank account needed. Just ID verification and a phone number.That’s how a small factory owner in Rostov buys machine tools from Turkey. He sells rubles for USDT on EXMO, sends the stablecoin to a Turkish supplier, and the supplier cashes out in lira. No SWIFT. No intermediaries. No delays.

Or how a freelance designer in Kazan gets paid by a client in India. She receives USDT into her wallet, holds it until the ruble strengthens, then sells it for rubles. She avoids losing 15-20% of her income to currency devaluation.

But it’s not smooth. Users report account freezes, verification delays, and sudden policy changes. One user lost 250,000 rubles in a market opportunity because his exchange account was locked for three weeks during a compliance review. Another had his funds seized after a regulator flagged a large USDT deposit as "suspicious." There’s no appeal process. No consumer protection. Just silence.

What’s Missing

Russia’s crypto scene is strong in one area - moving value across borders. It’s weak in others. DeFi? Almost nonexistent. NFTs? Rarely used. Crypto loans? Limited to a few platforms. Most Russians don’t know what a liquidity pool is. They don’t need to. They just need to send money.There’s also no real infrastructure for merchants. No crypto debit cards. No POS systems. No tax guidelines for crypto income. If you earn crypto, you’re supposed to report it as income - but there’s no clear way to do it. The tax service doesn’t have tools to track it. So most people don’t.

And then there’s security. With no regulated exchanges, users store crypto in personal wallets. Many don’t use hardware wallets. They use phone apps. That’s risky. There are no public reports of hacks, but anecdotal evidence suggests fraud is common. Fake exchanges. Phishing scams. Telegram groups promising "guaranteed returns." People lose money. Often.

The Future: Control or Integration?

The Bank of Russia is planning a nationwide survey of crypto holdings and lending activity from January to February 2026. That’s not random. It’s preparation. They’re gathering data to build a regulatory framework - likely one that brings crypto under the same oversight as banks.By 2026, experts predict 23.5 million Russians - 16% of the population - will be using crypto. That’s growth, but not explosion. The limit isn’t tech. It’s trust. People will keep using crypto because they have to. But they won’t trust it until the state gives it a legal home.

Will Russia create its own digital ruble and push crypto out? Maybe. But right now, the digital ruble is slow, limited, and unpopular. Crypto is fast, global, and working. So the state is walking a tightrope: crack down enough to maintain control, but not so hard that it pushes people further underground.

For now, crypto in Russia isn’t a financial revolution. It’s a quiet, daily act of resilience. People aren’t betting on the future. They’re holding onto it - one USDT at a time.