WBTC Conversion Calculator

Convert BTC to WBTC

Understanding WBTC Risks

When converting BTC to WBTC, you're taking on certain risks:

- You must trust the custodians and merchants

- You're subject to KYC/AML verification

- Gas fees on Ethereum may fluctuate

Ever wondered how you can use your Bitcoin on Ethereum’s DeFi playground? That’s where Wrapped Bitcoin (WBTC) steps in, turning a Bitcoin into an ERC‑20 token that lives on the Ethereum network.

What is Wrapped Bitcoin?

Wrapped Bitcoin (WBTC) is an ERC‑20 token on Ethereum that represents Bitcoin at a 1:1 ratio. Launched in January 2019 by a trio of projects-Kyber Network, Ren Protocol, and BitGo-WBTC was the first practical bridge that let Bitcoin holders tap into Ethereum’s rapidly growing decentralized finance (DeFi) ecosystem.

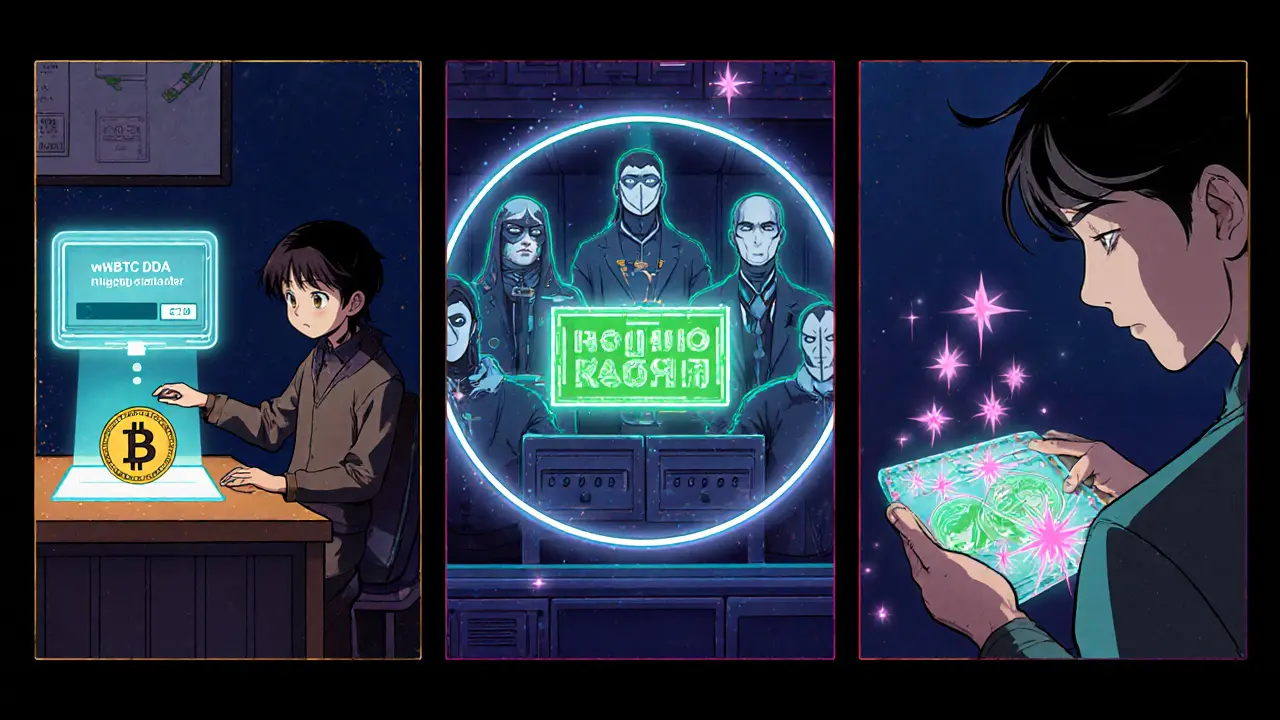

How does the wrapping process work?

The flow is simple on paper but involves a few moving parts behind the scenes:

- Send Bitcoin to an authorized merchant (often an exchange or a custodial service).

- The merchant forwards the Bitcoin to a custodian that holds the real coins in cold storage.

- Once the custodian confirms receipt, the WBTC DAO instructs a smart contract to mint an equivalent amount of ERC‑20 tokens.

- The new WBTC appears in your Ethereum wallet, ready for any DeFi protocol.

- When you want the original Bitcoin back, you send the WBTC to a merchant, the contract burns it, and the custodian releases the underlying Bitcoin.

All of this happens in minutes to a few hours, depending on Bitcoin network confirmations and the merchant’s internal processing time.

The players: Custodians, Merchants, and the wBTC DAO

Bitcoin is the original decentralized digital currency remains under the control of custodians, who are responsible for holding the real coins. Until August 2024 BitGo was the sole custodian; the protocol then switched to a shared‑custody model that includes BiT Global, spreading risk and adding a dash of decentralization.

Merchants are the front‑line operators that on‑board users, run KYC/AML checks, and coordinate the mint‑burn workflow. Think of them as the gateway between the Bitcoin world and the Ethereum smart‑contract world.

The wBTC DAO is the governance body that oversees the protocol through a multi‑signature wallet. Members include Kyber Network, Compound, and other DeFi projects that safeguard the 1:1 peg by voting on new custodians, fee structures, and upgrades.

Why use WBTC? The main benefits

- DeFi access: Instantly use Bitcoin as collateral on platforms like Compound and Aave, or provide liquidity on Uniswap without leaving the Ethereum ecosystem.

- Fast settlement: Ethereum transactions confirm in seconds, far quicker than Bitcoin’s 10‑minute block time.

- Full ERC‑20 compatibility: Any wallet, DEX, or smart contract that supports ERC‑20 tokens works with WBTC out of the box.

- Liquidity: WBTC is the most widely adopted Bitcoin‑backed asset, meaning deep pools and tight spreads on major DEXs.

What are the downsides? The main risks

- Centralized custody: Users must trust custodians and merchants to safeguard the underlying Bitcoin.

- Regulatory exposure: Custodians are subject to KYC/AML rules, which may be cumbersome for privacy‑focused users.

- Ethereum gas fees: During network congestion, minting or swapping WBTC can become pricey.

- Bridge alternatives: Trustless bridges (e.g., Thorchain, RenVM) offer similar functionality without a custodian, though they carry their own technical risk.

Wrapped Bitcoin vs. other Bitcoin‑on‑Ethereum solutions

| Token | Custody Model | ERC‑20 Compatibility | Decentralization Score* (1‑5) | Typical Use Cases |

|---|---|---|---|---|

| WBTC | Shared custodians (BitGo, BiT Global) | Full | 3 | Collateral, liquidity provision, yield farming |

| renBTC | RenVM (decentralized network of nodes) | Full | 4 | Trustless bridge, cross‑chain swaps |

| tBTC | Threshold signatures (fully trustless) | Full | 5 | High‑security DeFi, research labs |

| imBTC | Immune (centralized custodian) | Full | 2 | Simple swaps, low‑risk exposure |

*Score reflects how much trust is placed in code vs. third‑party custodians. WBTC scores in the middle because it mixes regulated custodians with DAO oversight.

Getting started with WBTC: Step‑by‑step guide

- Own some Bitcoin (BTC) in a wallet or on an exchange.

- Choose a merchant that supports WBTC conversion-popular options include Binance, Coinbase, and Kraken.

- Complete any required KYC/AML verification; this is standard for custodial services.

- Send the exact amount of BTC to the merchant’s designated address.

- Wait for the custodian to confirm receipt (usually one Bitcoin block confirmation).The merchant notifies the wBTC DAO, which mints the same amount of WBTC on Ethereum.

- Check your Ethereum wallet (e.g., MetaMask) - the new WBTC should appear instantly.

- Now you can deposit WBTC into any DeFi protocol, swap on Uniswap, or hold it as a stable Bitcoin‑peg.

To unwrap, reverse the process: send WBTC back to a merchant, they burn the tokens, and the custodian releases the original BTC to your Bitcoin address.

Real‑world use cases

DeFi platforms have built entire products around WBTC. Here are three common scenarios:

- Collateralized lending: Supply WBTC on Compound or Aave to borrow stablecoins like USDC, letting you keep Bitcoin exposure while unlocking liquidity.

- Liquidity provision: Pair WBTC with ETH on Uniswap V3. Earn a share of trading fees and, if you’re comfortable with risk, capture extra yield through liquidity mining incentives.

- Yield farming: Stake WBTC‑LP tokens in incentivized farms (e.g., Yearn) to earn additional protocol tokens on top of fee revenue.

Recent developments and the future outlook

The most notable change in the last year was the August 2024 shift to a shared‑custody model with BiT Global. This move was meant to reduce single‑point‑failure risk and give the DAO more levers for governance. Early data show a slight uptick in total WBTC supply, indicating growing trust from the community.

Looking ahead, the wBTC DAO is exploring two major upgrades:

- Adding more custodians to further spread risk and possibly lower fees.

- Extending the token to other EVM‑compatible chains like Polygon and Avalanche, which would let Bitcoin holders tap into cheaper gas markets while keeping the 1:1 peg.

Competition is heating up, though. Decentralized bridges such as Thorchain and the rise of native Bitcoin DeFi layers (e.g., Stacks) could erode WBTC’s market share if they prove secure and user‑friendly. Still, WBTC’s first‑mover advantage, deep integration with major protocols, and regulated custodian backing give it a solid moat for the near future.

Key Takeaways

- Wrapped Bitcoin turns BTC into an ERC‑20 token, unlocking fast, cheap access to Ethereum DeFi.

- The token is fully backed 1:1 by Bitcoin held by regulated custodians, overseen by the wBTC DAO.

- Benefits include liquidity, collateral options, and compatibility with any Ethereum smart contract.

- Risks revolve around centralized custody, regulatory KYC, and Ethereum gas costs.

- Recent shared‑custody upgrades improve decentralization, and future expansions may bring WBTC to other blockchains.

In short, Wrapped Bitcoin bridges the gap between Bitcoin’s store‑of‑value reputation and Ethereum’s programmable finance, offering a practical way for holders to earn more without selling their BTC.

What is the main difference between WBTC and regular Bitcoin?

WBTC is an ERC‑20 token that represents Bitcoin on Ethereum. While regular Bitcoin lives on its own blockchain with slower transactions, WBTC can be moved instantly on Ethereum and used in DeFi apps, but it relies on custodians to hold the actual BTC.

How safe is the 1:1 backing guarantee?

The guarantee is enforced by the wBTC DAO and custodians. Every minted WBTC must be matched by a Bitcoin held in cold storage. Audits and multi‑signature controls are used to verify the reserve, but users still trust the custodians' security practices.

Can I use WBTC on non‑Ethereum chains?

Yes, many projects have deployed WBTC wrappers on EVM‑compatible chains like Polygon, Binance Smart Chain, and Avalanche. The token keeps the same contract address on each chain via a bridge, letting you move it with less gas.

What fees should I expect when wrapping Bitcoin?

Typical fees include a small network fee for the Bitcoin transfer, a merchant fee (often 0.1‑0.5 %), and the Ethereum gas cost for the mint transaction. During high network demand, gas can become the dominant expense.

Is there a way to unwrap WBTC without a merchant?

Currently the protocol requires a merchant to handle KYC and coordinate the burn process. Some platforms offer a streamlined UI, but a third party is still needed to release the underlying Bitcoin.