Virgo (VIRGO) isn’t just another obscure crypto coin - it’s a ghost town with a website still online. Launched in October 2021 as a BEP-20 token on Binance Smart Chain, Virgo was meant to be the fuel for the Virgo Wallet, a browser extension that promised to simplify multi-chain crypto use. But today, the project feels like it vanished overnight. If you’re wondering whether Virgo is worth your time or money, the answer isn’t in the price charts - it’s in the silence.

What Virgo (VIRGO) was supposed to do

Virgo Coin wasn’t built to be a store of value or a payment tool. It was designed as a utility token - a digital key that unlocks perks inside the Virgo Wallet ecosystem. Holders were promised three things: partial refunds on transaction fees, exclusive airdrops, and lower exchange rates when swapping tokens. The real hook? Staking. The Virgo Farm program claimed to offer up to 36.4% APY, far higher than most wallet tokens like Trust Wallet Token (TWT), which typically pay 5-10%.

That kind of return sounds tempting, especially in a market where most staking rewards are modest. But high yields aren’t magic. They’re usually a signal - either of strong demand or, more often, of unsustainable mechanics. In Virgo’s case, the numbers don’t add up.

The data doesn’t match - and that’s a red flag

Look at the numbers across platforms, and you’ll see chaos. CoinGecko says Virgo’s market cap is $787,303. Holder.io says it’s $75,800. Binance and CoinStats list the circulating supply as zero. Meanwhile, CoinGecko claims nearly 1 billion tokens are in circulation, while Holder.io says there are more than 1 billion - even though the max supply is capped at 1 billion.

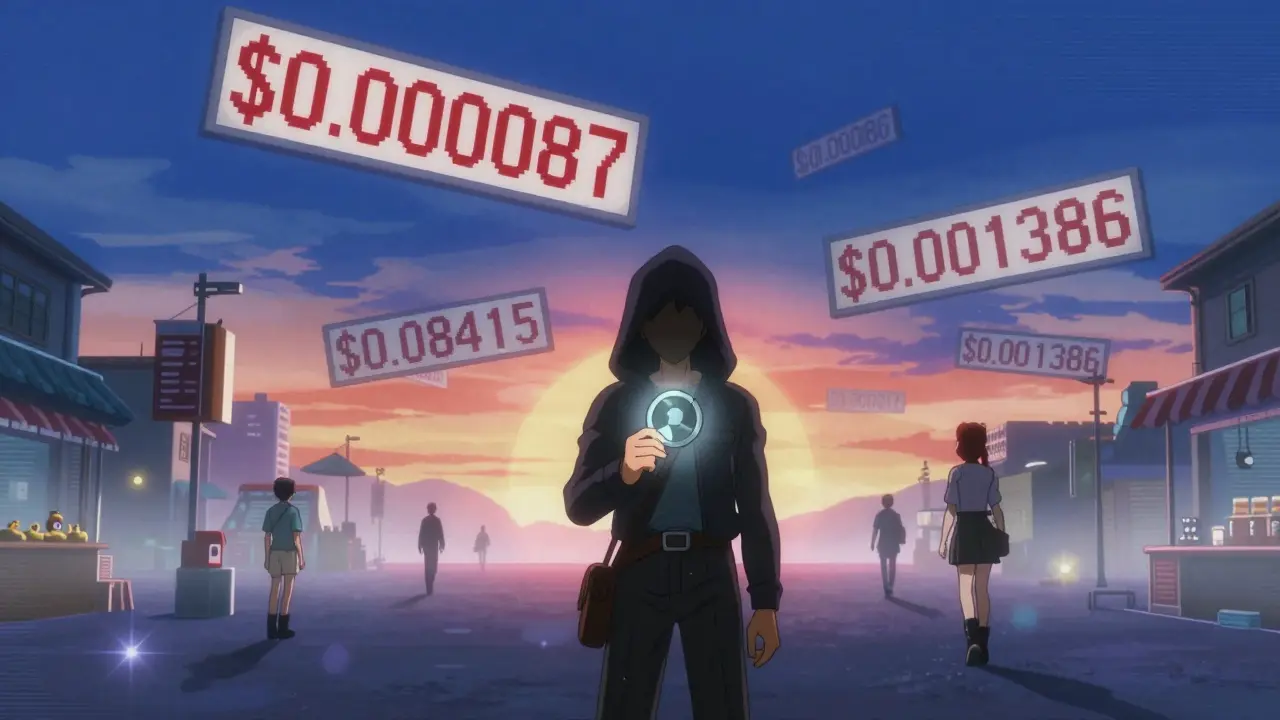

Price? Even worse. CoinGecko says VIRGO trades at $0.000087. CoinStats says $0.08415. That’s a 967% difference. Binance shows $0.001386. Which one is real? None of them - because there’s no real market. The 24-hour trading volume on CoinGecko is under $17,000. On Binance, it’s $54,000. That’s not liquidity. That’s noise.

Experts call this kind of inconsistency a classic sign of wash trading - where bots buy and sell the same asset among themselves to fake activity. Or worse, it’s a dead project with stale data still crawling across platforms. When even the circulating supply can’t be agreed upon, you’re not investing in a coin. You’re betting on a spreadsheet error.

The Virgo Wallet is broken - and no one’s fixing it

Virgo Coin only has value if the wallet works. But users report the Virgo Wallet extension crashes constantly. The staking feature hasn’t paid out since September 2025. Support emails go unanswered. Reddit threads from January 2026 are full of posts like: “I staked 10 million VGO and saw zero returns. The dashboard says I’m active, but my wallet balance never changed.”

Trustpilot reviews for the Virgo Wallet average just 1.7 out of 5 stars. Out of 37 reviews, 32 mention zero customer support. 28 say the interface crashes. 25 say the promised token benefits never arrived. These aren’t complaints from a few disgruntled users. This is a pattern.

And the development team? Silent. The last Twitter post from the official Virgo account was October 22, 2025 - a vague promise of “major updates.” Nothing followed. The GitHub repo hasn’t had a single commit since August 15, 2025. No code changes. No bug fixes. No new features. When a project stops updating, it’s not in maintenance mode. It’s in mourning.

How Virgo compares to other wallet tokens

Virgo isn’t the only wallet utility token out there. Trust Wallet Token (TWT), used by the official Trust Wallet app, has a market cap of $85 million. Atomic Wallet Coin (AWC) trades with consistent volume and regular updates. Both have active teams, community engagement, and clear roadmaps.

Virgo? It’s a footnote. Ranked #4309 on CoinGecko and #4388 on Binance, it’s buried under hundreds of coins with more real activity. Even in the niche wallet token space - which has already lost 92% of its value since early 2025 - Virgo stands out as one of the most abandoned.

Yes, its staking APY looked better than TWT’s. But high rewards mean nothing if the contract is inactive. You can’t earn 36.4% from a staking pool that’s been shut down for months.

Why you should avoid Virgo (VIRGO)

There’s no such thing as a “good deal” when the system is broken. Virgo’s high APY was a lure. The real story is in the details:

- No active development: Zero commits since August 2025. No updates. No fixes.

- Unreliable data: Market cap, supply, and price vary by 10x across platforms.

- Broken features: Staking doesn’t pay. Wallet crashes. Support is gone.

- Low liquidity: You won’t be able to sell if you buy - no one’s buying.

- High risk of abandonment: CryptoRank gives it a 12/100 sustainability score.

Even if the price spikes tomorrow - and it might, thanks to low-volume pump-and-dumps - you’re not buying an investment. You’re buying a gamble on whether someone else will buy it off you before the last server shuts down.

What’s next for Virgo?

Most experts agree: Virgo is already functionally dead. CryptoSlate’s December 2025 report called it “a potentially abandoned project.” Dr. Eleanor Chen from Delphi Digital said the price discrepancies alone should scare off any serious investor.

Looking ahead, the Blockchain Research Institute predicts 68% of niche wallet utility tokens will vanish by the end of 2026. Virgo isn’t just at risk - it’s already on the list. There’s no official announcement of shutdown. No farewell tweet. Just silence.

If you hold VIRGO, you’re holding digital dust. If you’re thinking of buying, you’re not getting a coin. You’re getting a tombstone with a price tag.

What to do instead

If you want a wallet utility token with real staying power, look at TWT or AWC. Both have active teams, consistent updates, and transparent tokenomics. Or stick with the big players: MetaMask, Trust Wallet, or Phantom. Their ecosystems are built to last.

Virgo (VIRGO) might still show up on your exchange’s list. Don’t be fooled. It’s not a coin. It’s a cautionary tale.