Seedify.fund isn’t just another crypto token. It’s a funding engine built for the next wave of blockchain games and NFT projects. If you’ve ever wondered how new gaming apps on blockchain get their start, or why some crypto coins jump fast while others fade, Seedify.fund (SFUND) is one of the key players behind the scenes.

What Seedify.fund Actually Does

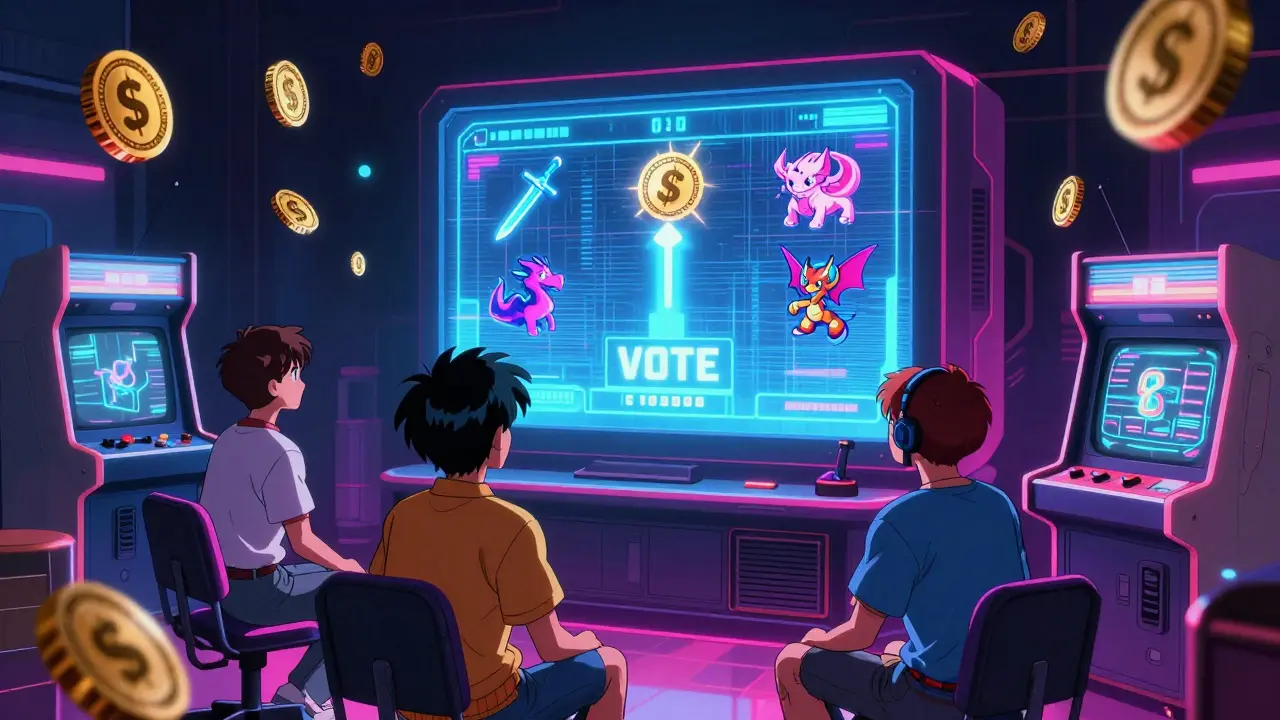

Seedify.fund is a launchpad - think of it like a startup incubator, but for blockchain projects. Instead of venture capitalists deciding which ideas get money, Seedify lets its community vote. Holders of SFUND tokens decide which new games, NFT collections, or metaverse apps get funded. It’s decentralized, meaning no single company pulls the strings.

The platform doesn’t just raise money. It helps projects launch properly. That includes setting up token sales, protecting against bots that snap up all the coins at launch (called sniping), and even helping with marketing. Since 2021, it’s backed over 150 projects, mostly in blockchain gaming and NFTs.

How SFUND Works - The Token

SFUND is the heartbeat of Seedify.fund. It’s a BEP-20 token built on Binance Smart Chain, which means it’s fast and cheap to use compared to Ethereum. There are 100 million SFUND tokens total, and 88.5 million are already in circulation as of early 2026. The price hovers around $0.04, with daily trading volume near $300,000.

Unlike many crypto projects that mint new tokens to reward stakers, Seedify.fund uses a different model. When a project funded by Seedify succeeds, a portion of its tokens are distributed back to SFUND holders who staked their tokens. No inflation. No new coins printed. Just rewards from real success.

The Tier System - Why Holding More Matters

Here’s where Seedify.fund gets interesting. It’s not just about owning SFUND - it’s about how much you hold and how long you lock it up. There are nine tiers, from Level 1 to Level 9. The more SFUND you stake and the longer you lock it (between 30 and 270 days), the higher your tier.

Higher tiers mean bigger access. If a new blockchain game is launching, only people in Tier 7 or above might get to buy tokens before the public. Tier 9 holders get the largest allocations. This system rewards long-term supporters. If you believe in a project, you’re not just buying in - you’re helping it succeed, and you get paid for it.

How Projects Get Funded

Seedify.fund doesn’t just accept any project. There are four ways a project can launch:

- Degen - Open to anyone. Low vetting. Fast access. High risk.

- Curated by Seedify - Thorough review by the team. Higher chance of success.

- Curated by Partners - Backed by trusted names in crypto gaming.

- Community Voting - SFUND holders vote on whether to fund it.

Projects that pass the review get $75,000 in funding. Seedify.fund keeps 3% of the project’s tokens as a fee. That’s how they stay funded. It’s a simple model: help projects grow, get a small cut, and share the upside with stakers.

What Makes It Different

Compare Seedify.fund to Binance Launchpad or Polkastarter. Binance picks projects themselves. Polkastarter is broad - funding DeFi, NFTs, everything. Seedify.fund is laser-focused: blockchain gaming and the metaverse.

That focus matters. The blockchain gaming market is exploding. It was worth $145 million in 2020. By 2025, it’s expected to hit $15.7 billion. Seedify.fund isn’t chasing every trend. It’s betting on the one with the biggest growth curve.

It also supports multiple chains: Ethereum, Polygon, Avalanche, Fantom, BSC, and Sei. That means projects can launch where it makes sense - not just on one network. This flexibility gives it an edge over platforms locked into a single blockchain.

The Other Token: SNFTS

Seedify.fund doesn’t stop at SFUND. It also has SNFTS, a token airdropped to SFUND stakers and certain NFT holders. SNFTS is used within the platform’s NFT marketplace, called NFT Space. It has a 1% transaction fee, compared to SFUND’s 2%. Think of SNFTS as the utility token for buying and trading NFTs on Seedify’s ecosystem.

It’s not as big as SFUND, but it adds depth. If you’re into gaming NFTs, holding SNFTS gives you access to exclusive drops and discounts.

Who Uses Seedify.fund?

Most users are crypto-savvy gamers or early investors. Around 68% are male, aged 25-44. The biggest user bases are in North America (32%), Southeast Asia (28%), and Europe (25%).

Setting up takes a little effort. You need a Web3 wallet like MetaMask or Trust Wallet. You have to buy SFUND on exchanges like MEXC. Then you stake it, choose your tier, and wait for launches. New users often spend 2-4 hours learning the ropes. The good news? Seedify.fund has detailed video guides and a Discord with over 35,000 active members ready to help.

The Risks

Seedify.fund isn’t risk-free. Its market cap is around $3.5 million - small compared to giants like Binance Launchpad. Trading volume is low, which means prices can swing fast. If the blockchain gaming bubble pops, Seedify.fund could struggle.

Also, its success depends on the projects it funds. As of late 2025, 63% of funded projects showed positive post-launch performance. That’s decent, but not perfect. Some fail. You could lose money if you invest early in a project that doesn’t take off.

Regulatory gray areas exist too. Some jurisdictions treat SFUND like a security. Seedify.fund requires KYC for higher-tier access to stay compliant, but it’s still a patchwork of rules across countries.

Is It Worth It?

If you’re into blockchain gaming and want early access to the next big thing - yes. Seedify.fund gives you a direct line to projects most people never hear about until they’re already up 10x.

It’s not for passive investors. You need to stake, track tiers, and pay attention to launches. But if you’re willing to put in the time, it’s one of the few platforms where your holdings directly influence what gets built.

It’s not a get-rich-quick scheme. But for those who understand the space, it’s a smart way to back the future of gaming - and get rewarded for it.

What’s Next for Seedify.fund?

The roadmap is clear: more chains, better tools, and full community governance. By 2026, they’re aiming to let SFUND holders vote on every project without team interference. They’re also expanding NFT Space and improving the user interface.

Analysts from Delphi Digital believe niche launchpads like Seedify.fund will control 35-40% of the launchpad market by 2027. If that happens, SFUND could grow alongside the gaming boom it’s betting on.

What is SFUND used for?

SFUND is the main token of Seedify.fund. It’s used to vote on which blockchain projects get funded, to stake and earn rewards from successful launches, and to access higher allocation tiers for new token sales. It’s the key to participating in the platform’s governance and investment system.

Can I mine SFUND?

No, SFUND cannot be mined. It runs on Binance Smart Chain using a Proof-of-Staked-Authority (PoSA) consensus, which doesn’t require mining. The only way to get SFUND is to buy it on exchanges like MEXC or stake existing tokens to earn rewards from funded projects.

How do I start using Seedify.fund?

First, get a Web3 wallet like MetaMask or Trust Wallet. Buy SFUND on exchanges such as MEXC. Then, connect your wallet to Seedify.fund’s website, stake your SFUND tokens, and choose a staking period (30-270 days). Higher stakes and longer lock-ups unlock better access to new project launches.

Is Seedify.fund safe?

The platform itself has been live since 2021 with no major hacks. However, like all crypto platforms, it carries risks. Project failures, price volatility, and regulatory changes can affect your returns. Always do your own research before staking or investing in any project launched through Seedify.fund.

What’s the difference between SFUND and SNFTS?

SFUND is the governance and staking token used to vote on projects and earn rewards. SNFTS is a separate token airdropped to SFUND stakers and NFT holders, used mainly for transactions in Seedify’s NFT marketplace. SFUND has a 2% transaction fee; SNFTS has a 1% fee.

Can I use Seedify.fund on mobile?

Yes. You can access Seedify.fund through any mobile browser using a Web3 wallet like Trust Wallet or MetaMask. The platform’s interface works on phones, though some features like staking and tier management are easier on desktop. There’s no official app yet, but the website is fully responsive.

Which blockchains does Seedify.fund support?

Seedify.fund supports Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, and Sei. This multi-chain approach lets projects choose the best network for their needs - whether it’s low fees, fast speeds, or strong community support.

How are project winners chosen?

Projects are chosen through four methods: Degen (open), Curated by Seedify (team-vetted), Curated by Partners (trusted collaborators), or Community Voting (SFUND holders vote). The most successful projects usually come from the Curated or Community Voting paths, where due diligence is higher.

Seedify.fund isn’t for everyone. But if you’re excited about the future of gaming on blockchain - and you’re ready to learn how to stake, vote, and invest - it’s one of the most direct ways to be part of it.