What if you could place a trade faster than a blink of an eye? That’s the promise from Trader One - a crypto exchange that claims to execute trades in just 112 microseconds. To put that in perspective: it’s quicker than the average stock market trade at 126 microseconds. If you’re a day trader, scalper, or algorithmic bot operator, that kind of speed sounds like magic. But here’s the real question: is Trader One actually reliable, or is it all flash and no substance?

Speed Isn’t Just a Feature - It’s the Whole Product

Trader One doesn’t try to be everything. It doesn’t offer 1,000 cryptocurrencies, it doesn’t have a fancy mobile app with live charts, and it doesn’t market itself to beginners. It’s laser-focused on one thing: execution speed. Their infrastructure is built from the ground up to cut out every millisecond of delay. That means direct market access, co-located servers, and custom hardware designed for microsecond-level timing. This isn’t about convenience - it’s about winning trades before others even register the price change.For professional traders, this matters. A 100-microsecond edge can mean the difference between capturing a $0.0002 profit on a Bitcoin trade or missing it entirely. When you’re placing thousands of orders a day, those fractions add up. That’s why Trader One’s commission-free model makes sense - they’re not making money on fees. They’re making money on volume, liquidity provision, and possibly rebates from market makers who need ultra-fast access.

But Free Trading Raises Red Flags

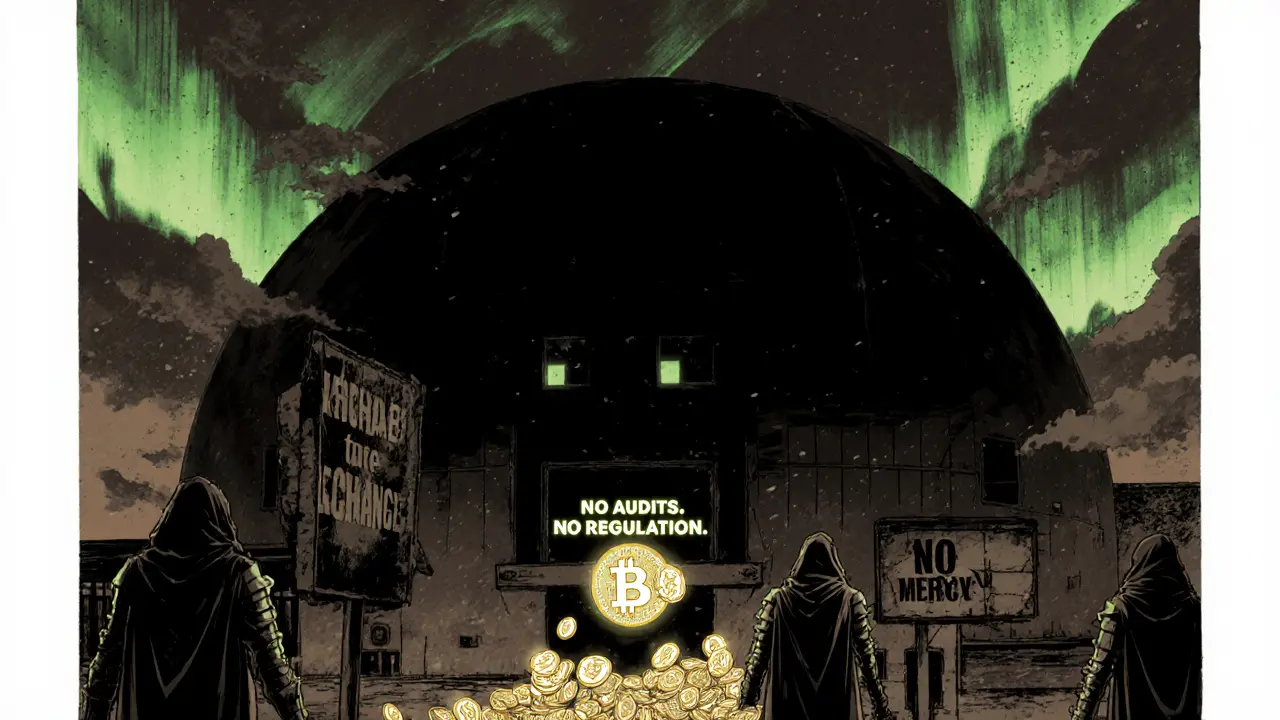

No trading fees? Sounds too good to be true. And it is - if you don’t understand how it works. Most exchanges charge you to trade because they’re the middleman. Trader One removes that layer. But who pays for the servers, security, and engineering? The answer isn’t public.Here’s what we know: exchanges that offer zero fees often make money through other channels. Maybe they earn from payment processing fees on deposits. Maybe they route orders to liquidity providers and take a cut behind the scenes. Maybe they offer premium API access or co-location services for institutional clients. But without transparency, you’re trusting them with your capital based on a promise - not proof.

Compare that to Binance or Kraken. They charge 0.1% per trade, but they’ve been around for years. They’ve survived multiple crypto winters. They publish regular security audits. They’ve got cold storage for 95%+ of user funds. Trader One? No public audit reports. No details on fund storage. No history of handling market crashes. That’s a big risk for anyone trading more than pocket change.

Who Is Trader One Really For?

If you’re a casual investor buying Bitcoin once a month, Trader One is overkill. You won’t feel the difference between 112 microseconds and 500 milliseconds. You’ll care more about whether you can buy Ethereum with a credit card, or if you can withdraw your funds without a 3-day wait.Trader One targets one group: algorithmic traders who need speed to survive. Think hedge funds running arbitrage bots between exchanges, or quant teams exploiting tiny price gaps across markets. For them, latency is the enemy. Every microsecond saved is money earned.

But even then, there’s a catch. Most professional traders use APIs to connect their bots. Does Trader One offer a stable, documented API? Can you test your strategies in a sandbox before going live? Is there 24/7 support if your bot goes rogue at 3 a.m.? These are critical questions - and right now, there’s no public answer.

No Regulatory Paper Trail

One of the biggest red flags in crypto is opacity around regulation. Binance operates under licenses in multiple jurisdictions. Coinbase is regulated in the U.S. and EU. Even smaller exchanges like Bitstamp publish their financial compliance status. Trader One? Nothing. No mention of registration with the FCA, ASIC, or any other financial authority. That’s not just a gap - it’s a warning sign.Without regulation, you have no legal recourse if things go wrong. If your funds disappear, there’s no ombudsman to call. If they freeze withdrawals, you can’t file a complaint with a government body. In 2025, after the collapse of FTX and the ongoing crackdowns on unlicensed platforms, trading on an unregulated exchange is like driving without insurance - you might get lucky, but you’re taking a huge gamble.

Security: A Black Box

Security isn’t just about having two-factor authentication (2FA). It’s about how your funds are stored, how withdrawals are approved, and whether the company has been hacked before. Trader One doesn’t disclose any of this.Do they use multi-sig wallets? Do they have a withdrawal whitelist? Is there a delay on large withdrawals? Are their servers audited by third parties? Without answers, you’re forced to assume the worst. And in crypto, assuming the worst is often the only safe approach.

Compare that to Kraken, which keeps 95% of funds in cold storage and has never lost customer assets to a hack. Or Coinbase, which insures its hot wallet holdings. Trader One offers no such guarantees. If you’re trading $10,000 or more, that’s not a risk you should take lightly.

What’s Missing? Everything Else

Trader One doesn’t offer fiat on-ramps. You can’t deposit USD, EUR, or NZD directly. You need to bring in crypto from another exchange first. That’s a huge barrier for new users. It also means you’re already exposed to risk on another platform before you even get to Trader One.There’s no mobile app. No educational content. No staking. No lending. No NFT marketplace. No referral program. It’s a bare-bones trading terminal - stripped down to the essentials. That’s fine if you know exactly what you’re doing. But if you’re looking for a one-stop crypto shop, you’ll be disappointed.

Real Users? No Reviews. No Feedback.

Look on Trustpilot. Look on Reddit. Look on Twitter. There’s no chatter about Trader One. No user stories. No complaints. No praise. That’s unusual. Even obscure exchanges have at least a few people talking about them. The silence suggests either extreme niche usage - or that it’s too new, too small, or too risky for people to trust publicly.In crypto, word-of-mouth matters. If no one’s talking about it, ask yourself why. Is it because it’s too good to share? Or because no one’s using it because they’re scared?

The Bottom Line: Speed Has a Price

Trader One is not a scam - at least, not yet. But it’s also not a safe or trustworthy exchange for most people. It’s a high-risk tool for a very specific kind of trader: those who already understand the dangers of crypto, who have capital to lose, and who need microseconds to stay competitive.If you’re a professional trader with a team, a backup plan, and a tolerance for uncertainty, Trader One might be worth testing with a small amount. But if you’re anyone else - retail investor, long-term holder, beginner, or even intermediate trader - stick with regulated, well-established platforms. The speed advantage isn’t worth losing your life savings.

There’s a reason the biggest names in crypto don’t compete on speed alone. They compete on trust. And trust takes years to build - and seconds to destroy.

Is Trader One a legitimate crypto exchange?

Trader One operates as a crypto exchange with a clear technical focus on ultra-low latency trading. However, it lacks public regulatory licensing, security audits, or user reviews - all standard indicators of legitimacy in the industry. Without transparency, it cannot be considered a fully legitimate or trustworthy exchange for most users.

Can I deposit fiat currency like USD or NZD on Trader One?

No, Trader One does not support fiat on-ramps. You must already own cryptocurrency and transfer it from another exchange or wallet. This limits accessibility for beginners and adds an extra layer of risk, since you’re already exposed to another platform before even using Trader One.

Is Trader One safe for storing crypto?

There is no public information about how Trader One stores user funds. No details on cold storage, multi-sig wallets, or withdrawal protections. Without these safeguards, it’s not safe to store significant amounts of crypto on the platform. Always use a personal hardware wallet for long-term holding.

Why doesn’t Trader One charge trading fees?

Trader One likely generates revenue through indirect methods like rebates from market makers, premium API access, or order flow payments. Since they don’t disclose their business model, the exact source of income remains unclear. Zero fees are attractive, but they often come with hidden trade-offs.

Should I use Trader One instead of Binance or Coinbase?

Only if you’re a professional algorithmic trader who needs microsecond-level execution and understands the risks. For everyone else - including most retail traders - Binance, Kraken, or Coinbase are far safer choices with better security, regulation, customer support, and features.

Does Trader One have a mobile app?

No, Trader One does not offer a mobile application. The platform appears to be web-only, targeting desktop-based professional traders who prioritize speed over convenience.

Is Trader One available in New Zealand?

There is no official information confirming whether Trader One accepts users from New Zealand or any specific country. The lack of regulatory disclosure makes it impossible to determine regional availability. Always assume you’re not covered unless explicitly stated.

What cryptocurrencies does Trader One support?

The exact list of supported cryptocurrencies is not publicly available. Based on its focus on high-frequency trading, it likely supports major assets like Bitcoin, Ethereum, Solana, and a few other high-liquidity coins. But without official documentation, traders cannot know what pairs are available.