Imagine putting your money into a new cryptocurrency that promises 10x returns. The team looks professional. The Discord server is buzzing. You buy in. Then, one morning, you can’t sell. The price crashes to zero. The liquidity vanishes. The developers disappear. This isn’t a horror story-it’s a smart contract rug pull, and it happens more often than you think.

What Exactly Is a Rug Pull?

A rug pull is when the people behind a crypto project suddenly pull the plug and run off with all the money. The name comes from the phrase “pulling the rug out from under you”-one second you’re standing, the next you’re on the floor with nothing. In DeFi, this isn’t just a scam-it’s coded into the smart contract itself. Developers build a token, add it to a decentralized exchange like Uniswap or PancakeSwap, lure in investors with hype, and then trigger a function that drains the liquidity pool. All your tokens become worthless. Your money? Gone.The Three Main Ways Rug Pulls Happen

Not all rug pulls are the same. There are three main technical methods scammers use, each with different levels of sophistication and detection difficulty.Liquidity Pull: The Classic Drain

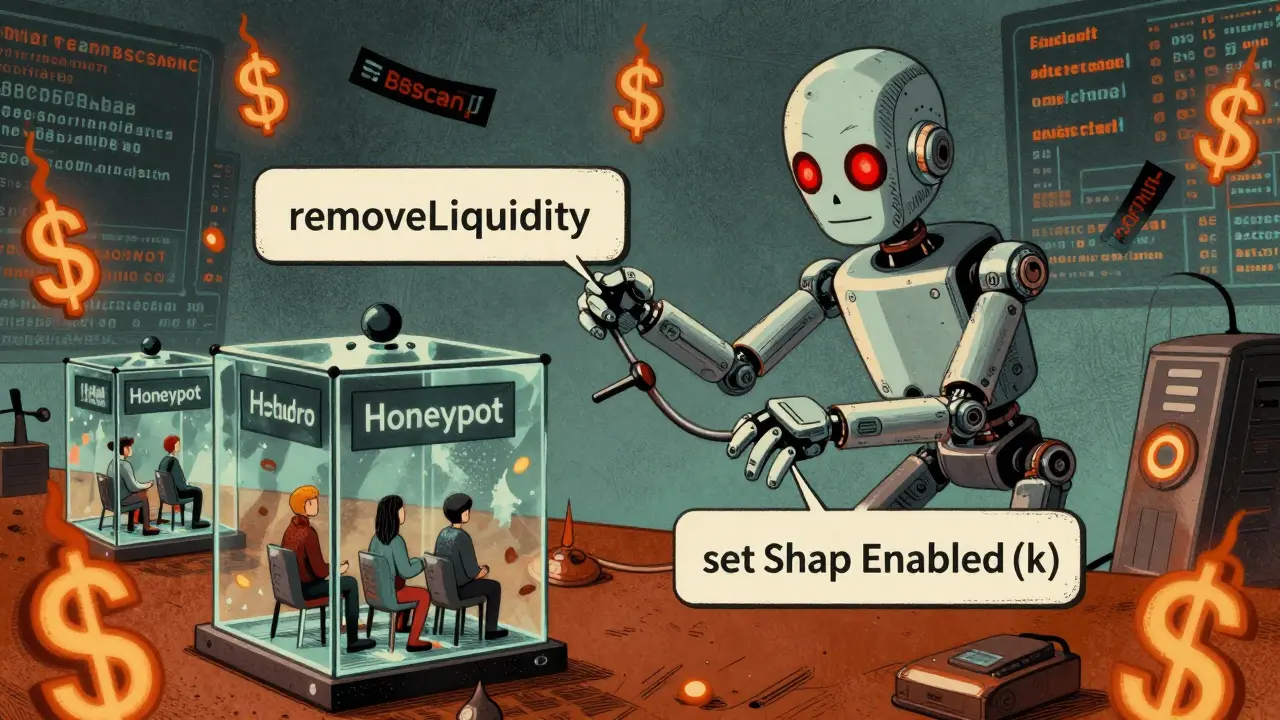

This is the most common type. Developers create a new token, pair it with ETH, BNB, or USDT, and add initial liquidity to a decentralized exchange. They promote it hard-Twitter threads, Telegram groups, influencer shoutouts. Investors rush in. The price climbs. Then, at the peak, the developers call theremoveLiquidity function. Boom. All the paired crypto in the pool-hundreds of thousands or even millions of dollars-is transferred to their wallets. The token’s price drops to near zero because there’s no liquidity left to trade it. Investors can’t sell. The contract didn’t break-it did exactly what it was coded to do.

The SQUID token in 2021 was a textbook case. It was tied to the Netflix show Squid Game, used fake celebrity endorsements, and promised a gaming platform. Investors poured in $30 million. Then, the devs drained the entire $3.38 million liquidity pool in one transaction. No warnings. No refunds. Just silence.

Honeypot: The Trap That Looks Like a Game

This is the most sneaky kind. The smart contract looks normal. You can buy the token. But when you try to sell? It fails. Every time. Why? Because the contract has a hidden rule: only the developer’s wallet can sell. Everyone else is locked in. This is called a honeypot-easy to enter, impossible to exit. The SQUID token also used this method. Even after the liquidity was pulled, many investors still tried to sell, thinking maybe the problem was temporary. They couldn’t. The contract didn’t allow it. Security researchers later found the code had a function that checked the sender’s address. If it wasn’t one of the whitelisted wallets, the sell transaction reverted. No error message. Just “transaction failed.” These contracts require advanced coding skills. That’s why they’re less common-but when they happen, they’re devastating. Investors don’t realize they’re trapped until it’s too late.Pump and Dump: The Social Engineering Scam

This one doesn’t need a backdoor in the code. It uses psychology instead. Developers mint a huge supply of tokens-say, 1 billion-and give themselves 80% of it. Then they launch a marketing blitz: “This is the next Bitcoin!” “President Milei supports it!” “Join the revolution!” In February 2025, the LIBRA token exploded after Argentinian President Javier Milei mentioned it on social media. Within hours, the price jumped 400%. Thousands of people bought in. But insiders-those holding the 82% of supply-started selling. Massive sell orders flooded the market. The price crashed 95% in under 12 hours. Over $107 million vanished. The contract? Technically fine. No fraud in the code. Just a massive imbalance in ownership and perfect timing. This is a “soft” rug pull. No code exploit. Just greed, coordination, and a crowd that didn’t check the tokenomics.

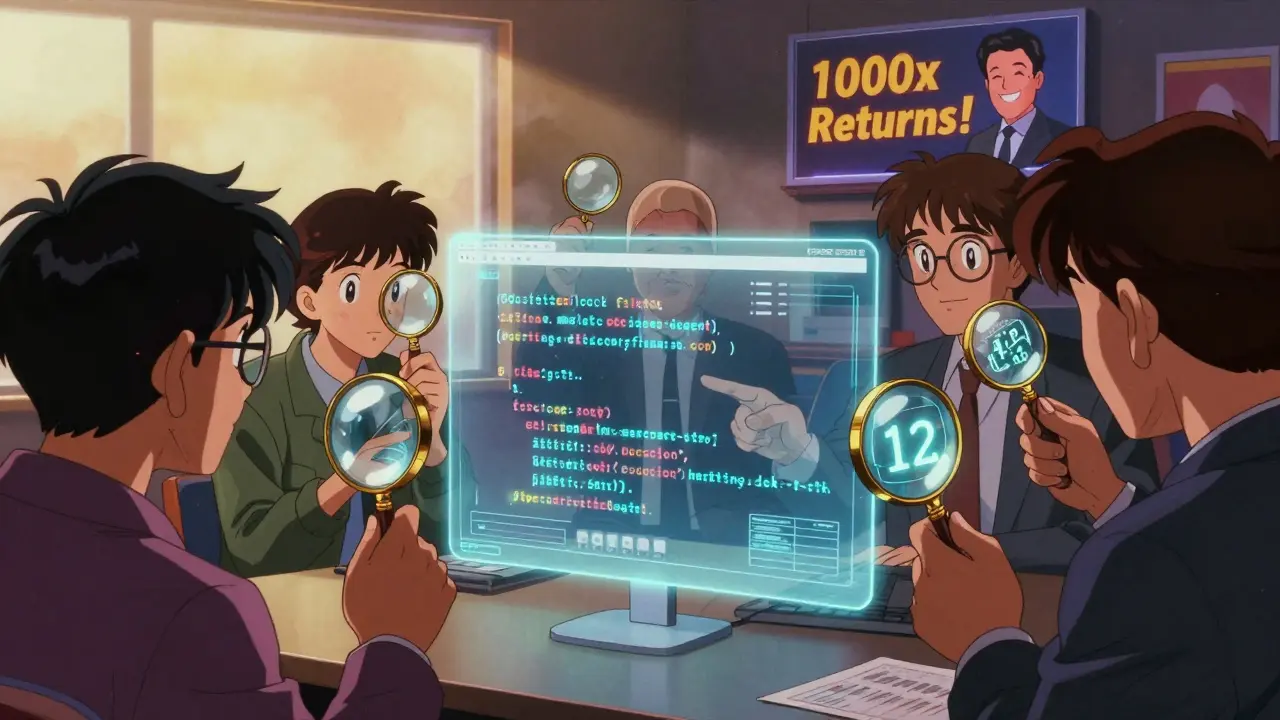

How to Spot a Rug Pull Before It’s Too Late

You don’t need to be a coder to protect yourself. Here are five red flags that show up in almost every rug pull:- Anonymous team: No names, no LinkedIn profiles, no real-world track record. Legit projects have public founders. If the team is “a group of anonymous devs,” run.

- No liquidity lock: If the project doesn’t lock its liquidity for at least 6-12 months, it’s a huge red flag. Locks mean the devs can’t pull the rug for a set time. Use tools like Unicrypt or Team Finance to check if liquidity is locked and by whom.

- Concentrated ownership: Check the token distribution. If one wallet holds more than 50% of the supply, that’s a dump waiting to happen. Sites like BscScan or Etherscan let you see wallet holdings. If the top 5 wallets control 70%+, it’s not a community project-it’s a casino.

- Unrealistic promises: “1000x returns in 7 days” or “guaranteed profits” are never real. If it sounds too good to be true, it is. Legit projects focus on tech, use cases, and roadmaps-not hype.

- No audit: If the contract hasn’t been audited by a reputable firm like CertiK, PeckShield, or Hacken, treat it like a loaded gun. Even an audit doesn’t guarantee safety, but an un-audited contract is a guaranteed risk.

Why Rug Pulls Keep Winning

You’d think after billions lost, people would learn. But they don’t. Why? First, DeFi is still new. Most people don’t understand how liquidity pools work or whatremoveLiquidity actually does. They see a rising price and assume it’s safe.

Second, social proof is powerful. If a tweet from a “crypto influencer” says “BUY NOW,” people follow. Even if the influencer is paid $50,000 to promote it.

Third, blockchain is immutable. Once the rug is pulled, there’s no undo button. No customer service. No chargeback. No bank to call. The money is gone forever.

And fourth, scammers are getting smarter. The LIBRA token wasn’t built on shady code-it was built on a president’s name. That’s not a bug. That’s a feature.

What You Can Do to Stay Safe

Here’s what works in real life:- Always check the contract: Go to BscScan or Etherscan. Look for the “Owner” address. Does it have functions like

setSwapEnabled(false)orsetFee(100%)? That’s a trap. - Test a small sell: Buy $10 worth. Try to sell it. If it fails, walk away. Don’t wait for the whole wallet to be drained.

- Use tools like RugDoc or TokenSniffer: These platforms scan contracts for honeypot flags, hidden admin rights, and liquidity risks. They’re not perfect, but they catch 80% of known scams.

- Never invest more than you can lose: Assume every new token is a scam until proven otherwise. Treat crypto like high-risk gambling-not investing.

- Follow the money: If the devs are moving funds to centralized exchanges right after launch, that’s a sign they’re cashing out. Watch the transaction history.

Is There Any Hope?

Yes-but not from regulators. Governments are slow. Blockchain is global. The real defense is community and education. More projects are now using time-locked liquidity and multi-sig wallets. Audits are becoming standard. Tools like DeFi Safety and Smart Contract Auditor are helping average users spot risks. But the biggest change? More people are asking questions before buying. They’re checking contracts. They’re testing sells. They’re refusing to fall for “CEO says buy” tweets. The rug pull isn’t going away. But the number of victims can drop-if you stop trusting hype and start checking code.Can you recover money after a rug pull?

No. Once a rug pull happens, the funds are transferred to the scammer’s wallet and the transaction is permanent. Blockchain is immutable-there’s no central authority to reverse it. Recovery efforts are almost always unsuccessful. The only way to avoid loss is prevention.

Are all anonymous projects rug pulls?

Not all, but most high-risk ones are. Legitimate anonymous projects exist-like early Bitcoin or Monero-but they usually have strong community trust, transparent code, and long-term development. If a project is anonymous, has no audit, and promises quick profits, treat it as a scam until proven otherwise.

How do I check if a token is a honeypot?

Use tools like TokenSniffer or RugDoc-they automatically scan for honeypot flags. You can also manually test by buying a tiny amount (like $5) and trying to sell. If the transaction fails with no error message, it’s likely a honeypot. Never buy more until you’ve tested this.

Can a smart contract audit prevent rug pulls?

Audits help, but they’re not foolproof. Most audits check for bugs, not malicious intent. A scammer can write code that looks clean but includes hidden functions like owner-only withdrawals. Always pair audits with liquidity locks and distribution checks. An audit is a starting point, not a guarantee.

Why do people still fall for rug pulls?

Because fear of missing out (FOMO) overrides logic. When a token spikes 200% in a day, people assume it’s safe and that others know something they don’t. Influencers, fake testimonials, and hype campaigns exploit this. The more emotional the pitch, the more dangerous the project.