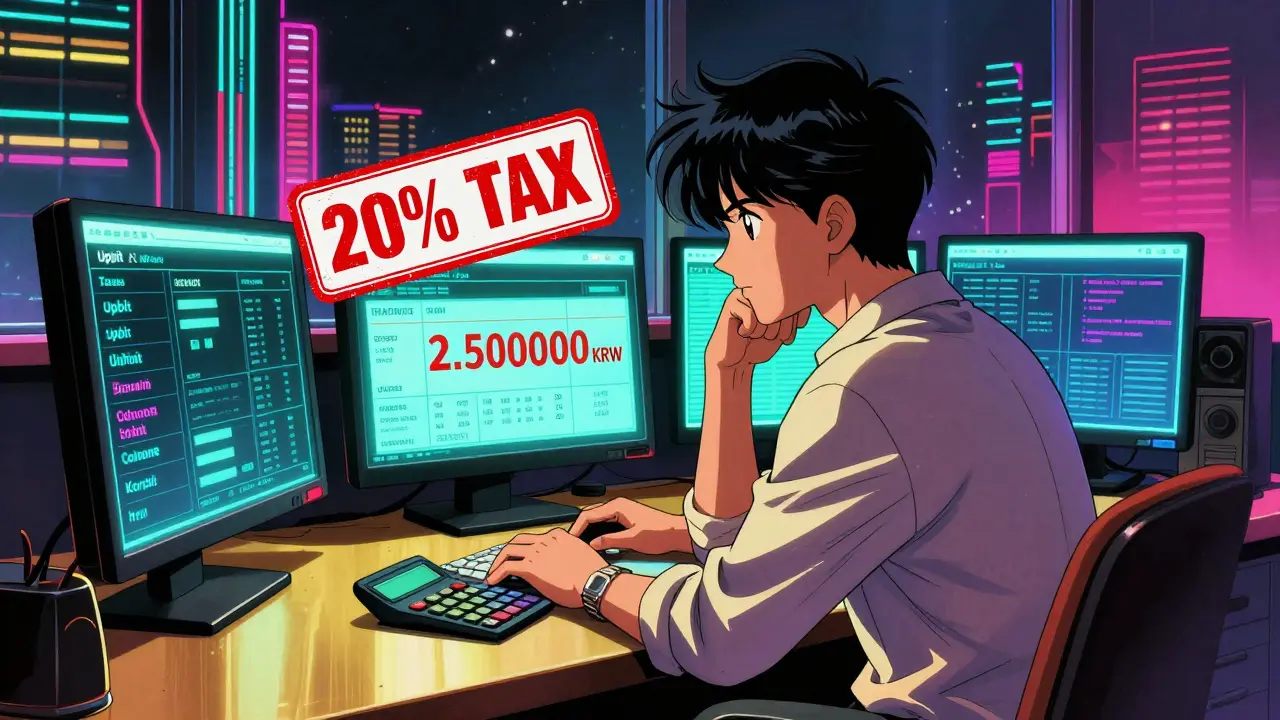

South Korea doesn’t just regulate cryptocurrency-it controls it. If you’re trying to trade crypto in Korea, you’re not just signing up for an app. You’re entering one of the strictest, most monitored crypto markets on Earth. No anonymous wallets. No offshore exchanges. No credit card buys. And if you make more than 2.5 million KRW in profits this year? You’re paying 20% in taxes. This isn’t speculation. It’s law.

Only Four Exchanges Are Legal

You can’t just pick any crypto platform in Korea. The Financial Services Commission (FSC) only allows four exchanges to operate legally: Upbit, Bithumb, Coinone, and Korbit. These aren’t just the biggest-they’re the only ones. Together, they handle over 95% of all domestic crypto trading. If you’re using any other app, you’re breaking the law. And if you’re caught, your funds could be frozen, your account shut down, or worse-fined. These four exchanges didn’t get their licenses by accident. Each had to pass a brutal checklist: ISMS-P certification (a top-tier cybersecurity standard), real-name bank partnerships, cold storage for at least 70% of customer assets, and mandatory cyber insurance worth 1 billion KRW ($750,000) per exchange. Since 2021, over 200 unlicensed platforms have been shut down. There’s no gray area here. If it’s not one of these four, it’s illegal.Real-Name Verification Is Non-Negotiable

You can’t trade crypto in Korea without linking your real identity to your wallet. Since 2018, every crypto account must be tied to a bank account under your exact legal name. No aliases. No family member’s account. No foreign bank transfers. You must use a Korean bank-KB Kookmin, Shinhan, or NH Nonghyup are the main partners. The system blocks any transaction that doesn’t match your ID. This isn’t just a formality. It’s how Korea stops money laundering and fraud. When you sign up, you upload your national ID card, take a video call with customer service, and confirm your bank details. The process takes 1-3 days. If your bank rejects the link (common for foreign accounts or minor accounts), you’re locked out. There’s no workaround. Even if you’re a foreigner living in Korea, you need a local bank account and a resident registration number to trade.What You Can’t Trade

Korean exchanges list far fewer coins than global platforms. Upbit and Bithumb offer around 200-300 cryptocurrencies. Compare that to Binance or Coinbase, which list over 600. Many popular altcoins-especially newer or low-market-cap tokens-are simply not available. Why? Because regulators require each coin to pass a risk assessment. Projects without clear teams, audits, or legal standing get blocked. DeFi protocols, NFT marketplaces, and crypto lending platforms are also restricted. Korean banks routinely block transactions to foreign wallets, even if you’re just trying to connect MetaMask. Many users report being unable to interact with Ethereum-based dApps without using a VPN-which, ironically, violates exchange terms of service. If you’re trying to access Uniswap or Aave from Korea, you’re fighting the system.How to Fund Your Account

You can’t buy crypto with a credit card in Korea. No PayPal. No international wire transfers. The only legal way to fund your account is through a domestic bank transfer in Korean Won (KRW). That means you need a Korean bank account. Even if you have a Korean visa, if you don’t have a local bank account, you can’t trade. Funding your exchange account is simple but slow. Log into Upbit or Bithumb, select “Deposit KRW,” copy your bank transfer details, and send the money from your verified account. The transfer takes 10-30 minutes. Once received, your crypto purchase is instant. But if you try to send funds from a foreign bank-even if it’s your own account-it will be rejected. No exceptions.20% Tax on Crypto Profits

Starting January 1, 2025, any profit over 2.5 million KRW ($1,800) from crypto trading is taxed at 20%. This applies to all individuals. No deductions. No exemptions. If you bought Bitcoin for 10 million KRW and sold it for 15 million KRW, your $3,600 profit is taxable. You must file this with your annual tax return. The FSC requires exchanges to report trading activity to the National Tax Service. There’s no hiding. Many traders are surprised by this. Some thought crypto was tax-free like stocks. It’s not. The tax applies to both short-term and long-term gains. Losses can offset gains, but only within the same tax year. If you lost money in 2024 but made a big profit in 2025, you still owe 20% on the 2025 gain. Record-keeping is now mandatory. Use spreadsheets or crypto tax software like Koinly or CoinTracker-both are widely used in Korea.Security Is Excellent-But at a Cost

Korea’s crypto exchanges have never suffered a major hack since the 2021 regulations took effect. That’s rare. Globally, over $3.8 billion was stolen from crypto platforms in 2023-2024. In Korea? Zero. Why? Because the rules force exchanges to store most assets offline, insure them, and audit constantly. Users report high satisfaction. A 2024 survey of 1,200 Korean traders showed 87% felt secure using Upbit or Bithumb. That’s far higher than the global average of 62%. But there’s a trade-off. Customer service is slower. Withdrawal limits are tighter. And you can’t move crypto off the exchange easily without going through extra verification steps. If you want to move your Bitcoin to a hardware wallet, you can-but only after 24-hour cooling periods and multiple confirmations. The system prioritizes safety over speed. For most retail traders, that’s a fair deal. But for active traders or arbitrageurs, it’s frustrating.

Who’s Winning and Who’s Losing

The big winners? The four licensed exchanges and institutional investors. Samsung Securities and KB Securities launched crypto custody services in 2024, letting wealthy clients hold Bitcoin through their brokerage accounts. The market is growing: 4.6 million Koreans traded crypto in 2024, and that number is projected to hit 6.2 million by year-end. The losers? Small exchanges, international traders, and innovators. New crypto startups can’t get a license. The cost of ISMS certification alone exceeds $375,000 per year. Many developers have moved to Singapore or Hong Kong, where rules are clearer and faster. Even some Korean traders are using offshore platforms-despite the legal risk-just to access more coins or DeFi tools.What’s Next?

In early 2025, Korea will launch a Central Bank Digital Currency (CBDC) pilot. The Bank of Korea is testing a digital won for retail use. This could change how people think about crypto. If the digital won is easy to use, fast, and secure, some might stop using Bitcoin or Ethereum altogether. Stablecoins like USDT and USDC are also under new scrutiny. As of September 2024, they must be fully backed by reserves and audited monthly. No more “proof of reserve” claims. Real audits. Real transparency. This is setting a global standard. The FSC says it wants to balance innovation and safety. But right now, safety wins. Every rule, every restriction, every tax-it’s designed to protect ordinary people from scams and losses. For many Koreans, that’s worth the trade-off. For others, it’s a wall.Bottom Line

Trading crypto in Korea isn’t about freedom. It’s about compliance. You get top-tier security, low fraud, and clear rules-but you lose flexibility, choice, and speed. If you’re a casual trader who wants to hold Bitcoin safely and pay your taxes, Korea’s system works. If you’re a power user who wants to trade every altcoin, use DeFi, or move funds freely-you’ll find it restrictive. There’s no middle ground. You either play by Korea’s rules-or you don’t play at all.Can I use Binance or Coinbase in South Korea?

No. Binance, Coinbase, and all other foreign exchanges are blocked from operating legally in South Korea. While some users access them via VPNs, this violates Korean financial regulations. Funds deposited on unlicensed platforms are not protected, and Korean banks will block transfers to them. If caught, you risk account freezes and legal penalties.

Do I need a Korean bank account to trade crypto in Korea?

Yes. You must have a real-name bank account with a Korean bank like KB Kookmin, Shinhan, or NH Nonghyup. International bank accounts cannot be linked to Korean crypto exchanges. Even if you’re a foreign resident, you need a local bank account and a resident registration number to complete verification.

How much tax do I pay on crypto profits in Korea?

As of January 1, 2025, any profit over 2.5 million KRW ($1,800) from crypto trading is taxed at 20%. This applies to all individuals, regardless of how long they held the asset. Losses can offset gains within the same year, but not across years. Exchanges report your trading activity to the National Tax Service, so hiding profits is not possible.

Why are so few cryptocurrencies available on Korean exchanges?

Korean regulators require each cryptocurrency to pass a risk assessment before listing. Projects without clear teams, audits, or legal compliance are blocked. This limits listings to around 200-300 coins, compared to 600+ on global platforms. The goal is to protect retail investors from scams and low-quality tokens.

Can I use a VPN to access foreign crypto exchanges from Korea?

Technically yes, but it’s risky. While using a VPN isn’t illegal by itself, depositing funds from a Korean bank to an unlicensed foreign exchange violates financial regulations. Banks may block the transaction, and if detected, you could face account restrictions or legal scrutiny. Most Korean traders avoid this due to the lack of legal protection and insurance.

Are Korean crypto exchanges safe from hacks?

Yes. Since the 2021 regulatory overhaul, none of the four licensed exchanges-Upbit, Bithumb, Coinone, Korbit-have suffered a major hack. They’re required to store 70%+ of assets in cold storage, carry cyber insurance, and meet strict ISMS-P security standards. This makes them among the safest crypto platforms globally.

Can I trade crypto in Korea without a government ID?

No. All users must complete Level 3 identity verification: submitting a government-issued ID, linking a real-name bank account, and completing a video call with the exchange. No exceptions. Anonymous trading is illegal in South Korea.