Interdax Leverage Liquidation Calculator

Calculate Your Risk

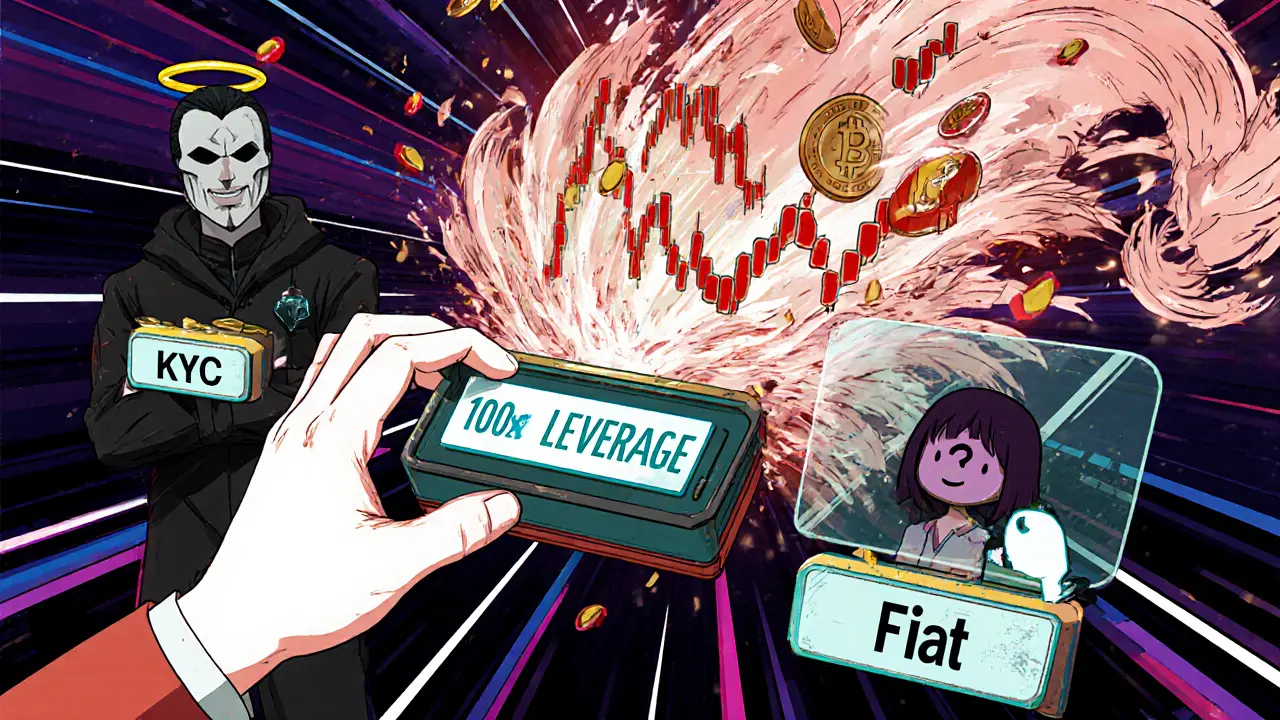

Interdax Crypto Exchange Review: High Leverage, No KYC, and What It Really Means for Traders

If you're tired of jumping through hoops just to trade crypto with high leverage, Interdax might sound like a breath of fresh air. No ID. No paperwork. No waiting. Just log in and start trading with up to 100x leverage. But is it too good to be true? For experienced traders who value privacy and speed over regulation, Interdax offers something rare in today’s crypto world: anonymity without sacrificing functionality. But for everyone else? It’s a minefield.

Launched in November 2019 and based in Seychelles, Interdax isn’t trying to be the next Binance. It doesn’t offer fiat deposits, doesn’t comply with MiCA or other global regulations, and doesn’t care if you’re a beginner. It’s built for one type of trader: those who know what they’re doing and want to do it without anyone watching.

How Interdax Works: No KYC, No Problem

Signing up for Interdax takes less than a minute. You don’t need an email. You don’t need a phone number. You don’t even need to remember a password if you use a wallet. That’s because Interdax doesn’t require KYC-ever. Your identity stays yours. No government forms. No selfie uploads. No third-party verification. This isn’t a loophole; it’s the entire business model.

But here’s the catch: you need crypto to trade. No USD, EUR, or GBP deposits. You can’t buy Bitcoin with a credit card here. You must already hold BTC, ETH, or USDT in another wallet and transfer it over. That limits who can use it. If you’re just getting into crypto and still holding dollars, Interdax isn’t for you. But if you’re already trading on other platforms and want to move your funds to a place that doesn’t ask questions? That’s where Interdax shines.

Trading Features: 100x Leverage and Sub-Accounts

Interdax offers both spot trading and derivatives contracts. The real draw? Derivatives with up to 100x leverage. That’s less than Binance’s 125x, but it’s still among the highest available on any no-KYC platform. And unlike Binance, you don’t need to pass KYC to unlock it. You get full access from day one.

What sets Interdax apart isn’t just the leverage-it’s the sub-account system. Most exchanges let you adjust leverage on a single account. Interdax splits your funds into two: Sub-Account 1 holds your open positions. Sub-Account 2 holds your extra funds. You can move money between them instantly and for free. Need to reduce risk? Transfer funds from Sub-Account 1 to Sub-Account 2. Need to boost your position? Do the reverse. It’s like having two wallets in one, designed to help you manage exposure without closing trades.

This system isn’t just clever-it’s rare. No other major derivatives exchange offers this level of granular control without requiring a premium subscription. For traders who use stop-losses, partial exits, or hedging strategies, this feature alone makes Interdax worth testing.

Fees: 0% Maker, 0.05% Taker

Fees on Interdax are among the most competitive in the industry. Makers (those who add liquidity by placing limit orders) pay 0%. Takers (those who remove liquidity by filling existing orders) pay just 0.05%. Compare that to Bybit’s 0.01% maker fee or BitMEX’s 0.00% maker fee-Interdax matches the best while keeping anonymity.

There are no withdrawal fees listed in any official review. That’s unusual. Most exchanges charge for crypto withdrawals to cover network costs. Interdax doesn’t mention them, which could mean they’re absorbed into the platform or passed through directly. Either way, it’s a win for frequent traders. The lack of hidden fees makes cost calculations simple-something many regulated exchanges fail at.

Security: No Regulation, But Solid Tech

Interdax isn’t regulated. That’s not a bug-it’s a feature. But that doesn’t mean it’s unsafe. The platform uses two-factor authentication via Google Authenticator, CAPTCHA for withdrawals, and PGP encryption for email communications. It also employs a shielded multi-signature scheme to protect customer funds, according to CoinCodeCap’s 2025 analysis.

There’s no insurance fund like Binance’s SAFT or Coinbase’s cold storage guarantees. There’s no FDIC-style protection. If the exchange gets hacked, your funds are gone. No recourse. No compensation. That’s the trade-off for no KYC. But the tech behind it is solid. The platform runs on a continuous settlement system, which reduces the risk of delays or batch errors common on older platforms like BitMEX.

Interdax also offers a testnet environment. New users get free demo BTC, ETH, and USDT to practice trading without risking real money. It’s a smart move for a platform that assumes you know what you’re doing. Use the testnet. Learn the sub-account system. Test your strategies. Then go live.

APIs and Automation: Built for Pros

Interdax doesn’t just support automated trading-it encourages it. The platform provides full REST and WebSocket APIs with clear documentation and working code examples. Developers can build bots for arbitrage, trend-following, or volatility strategies without hitting rate limits or needing special permissions.

This is a major plus for algorithmic traders. Unlike some exchanges that lock API access behind KYC or premium tiers, Interdax gives full API access to everyone. No restrictions. No waiting. Just plug in your keys and start coding. If you’re serious about automated crypto trading, this is one of the few platforms that doesn’t treat you like a customer-it treats you like a partner.

Who Is Interdax For? (And Who Should Stay Away)

Interdax isn’t for everyone. Here’s who it’s perfect for:

- Experienced crypto traders who already hold BTC, ETH, or USDT

- Traders who want 50x-100x leverage without submitting ID

- Those who use sub-accounts or complex risk management strategies

- Developers building trading bots who need open API access

- Privacy-focused users who distrust centralized exchanges

And here’s who should avoid it:

- Beginners who don’t understand leverage or liquidation risk

- People who want to deposit fiat or buy crypto with a bank card

- Those who need regulatory protection or insurance on funds

- Users who expect customer service to fix mistakes

Interdax doesn’t hold your hand. It doesn’t warn you when you’re about to get liquidated. It doesn’t send you educational emails. If you lose money because you didn’t know how to use sub-accounts properly? That’s on you. The interface is clean and intuitive, but the tools are advanced. Treat it like a race car-no seatbelts, no airbags, just raw speed.

How Interdax Compares to the Competition

| Feature | Interdax | Bybit | BitMEX | Binance Futures | Coinbase Advanced Trade |

|---|---|---|---|---|---|

| Max Leverage | 100x | 100x | 100x | 125x | 3x |

| KYC Required | No | Yes (for 100x) | Yes | Yes | Yes |

| Maker Fee | 0% | 0.01% | 0.00% | 0.02% | 0.00% |

| Taker Fee | 0.05% | 0.055% | 0.075% | 0.04% | 0.05% |

| Fiat On-Ramp | No | Yes | No | Yes | Yes |

| Sub-Account System | Yes | No | No | No | No |

| Regulated | No | Yes (in some regions) | No | Yes | Yes |

Interdax doesn’t win on volume. Binance does over $1.2 trillion in derivatives volume monthly. Interdax’s volume is a fraction of that. But it wins on freedom. If you want to trade 100x without giving your passport to a third party, Interdax is one of the only places left.

The Big Risk: Regulation Is Coming

Interdax’s biggest threat isn’t competition-it’s regulation. The EU’s MiCA framework, the U.S. SEC’s crackdowns, and global anti-money laundering standards are pushing exchanges toward compliance. Platforms like Bybit and Binance are adapting. Interdax isn’t.

That means one of two things will happen: either Interdax will shut down in major markets, or it’ll get blocked by banks and payment processors. Already, some users report difficulty funding wallets from certain crypto wallets due to intermediary filtering. This isn’t a technical issue-it’s a legal one.

If you’re using Interdax now, treat it like a temporary solution. Don’t store large amounts long-term. Don’t assume it’ll be here in 2026. Use it for active trading, not savings. Withdraw your profits regularly. Keep your exposure small. This isn’t a bank. It’s a tool.

Final Verdict: Powerful, But Not Safe

Interdax delivers exactly what it promises: high-leverage crypto derivatives trading with zero identity checks and low fees. The sub-account system is brilliant. The API is powerful. The interface is clean. And the lack of KYC is a rare gift in today’s crypto landscape.

But it’s also unregulated, uninsured, and vulnerable. There’s no safety net. No customer support team that can reverse a bad trade. No legal recourse if something goes wrong. You’re on your own.

If you’re an experienced trader who values privacy and control above all else, Interdax is worth a look. Use the testnet first. Learn the sub-accounts. Trade small. Then scale.

If you’re new to crypto, or if you need to feel protected? Walk away. There are safer platforms out there. But if you’re looking for raw, unfiltered trading power? Interdax still has it.

Is Interdax safe to use?

Interdax uses strong technical security like 2FA, PGP encryption, and a shielded multi-signature system. But it’s not regulated, doesn’t insure user funds, and has no legal obligation to protect you. If the platform is hacked or shuts down, you lose everything. It’s safe from a tech standpoint, but not from a legal or financial one.

Can I deposit fiat currency on Interdax?

No. Interdax only accepts cryptocurrency deposits like BTC, ETH, and USDT. You must buy crypto on another exchange first and transfer it over. There are no bank transfers, credit cards, or fiat on-ramps.

What’s the maximum leverage on Interdax?

Interdax offers up to 100x leverage on derivatives contracts. This is available to all users without KYC, unlike platforms like Binance or Bybit, which require identity verification for leverage above 20x.

Does Interdax have a mobile app?

No. Interdax is a web-based platform only. You can access it through any modern browser on desktop or mobile, but there is no official iOS or Android app. The interface is responsive and works well on phones, but you won’t find it in app stores.

Are there withdrawal fees on Interdax?

Interdax doesn’t list any withdrawal fees in its official documentation. This suggests either that fees are absorbed by the platform or passed directly through the blockchain network (like Bitcoin or Ethereum gas fees). Always check the withdrawal screen before confirming-network fees will still apply.

Is Interdax legal to use in the U.S.?

Interdax is not licensed to operate in the U.S. or most other regulated jurisdictions. While U.S. residents can technically access the platform, doing so may violate local laws around unregulated derivatives trading. The platform does not block U.S. IPs, but using it carries legal risk. Consult a financial lawyer before trading if you’re in a regulated country.

How does the sub-account system work?

Interdax splits your funds into two accounts: Sub-Account 1 holds your open positions and margin. Sub-Account 2 holds your extra funds. You can move funds between them instantly and for free. This lets you adjust leverage without closing trades-ideal for managing risk during volatile markets. For example, if you’re worried about liquidation, move funds from Sub-Account 1 to Sub-Account 2 to lower your leverage ratio.

Does Interdax offer customer support?

Yes. Interdax offers 24/7 customer support via live chat and email. Users report responsive service, especially for technical issues. But support can’t reverse trades, recover lost funds, or override system rules. They help with login issues, API errors, or interface questions-not financial disputes.

Next Steps: Try the Testnet First

Before you deposit any real crypto, go to Interdax’s testnet. You’ll get free demo BTC, ETH, and USDT. Use it to practice opening positions, moving funds between sub-accounts, and testing your strategies. See how liquidations work. Learn how leverage affects your margin. Get comfortable with the interface.

Once you’ve made a few successful trades on the testnet, you’ll know if Interdax fits your style. If it does, start small. Deposit only what you can afford to lose. Keep your leverage under 50x until you’re confident. And never store long-term holdings here.

Interdax isn’t a place to get rich. It’s a place to trade fast, trade anonymously, and trade with control. Use it wisely-or don’t use it at all.