Jordan Crypto Premium Calculator

Calculate how much you'd pay for Bitcoin under Jordan's pre-2025 P2P system versus the regulated system after Law No. 14.

Before September 2025, if you were a Jordanian who wanted to buy Bitcoin or trade Ethereum, you couldn’t do it through a bank. Not legally, anyway. The Central Bank of Jordan had made it clear: cryptocurrencies were not allowed in the country’s financial system. No exchanges. No crypto wallets linked to local accounts. No deposits or withdrawals through Jordanian banks. But people still traded. A lot.

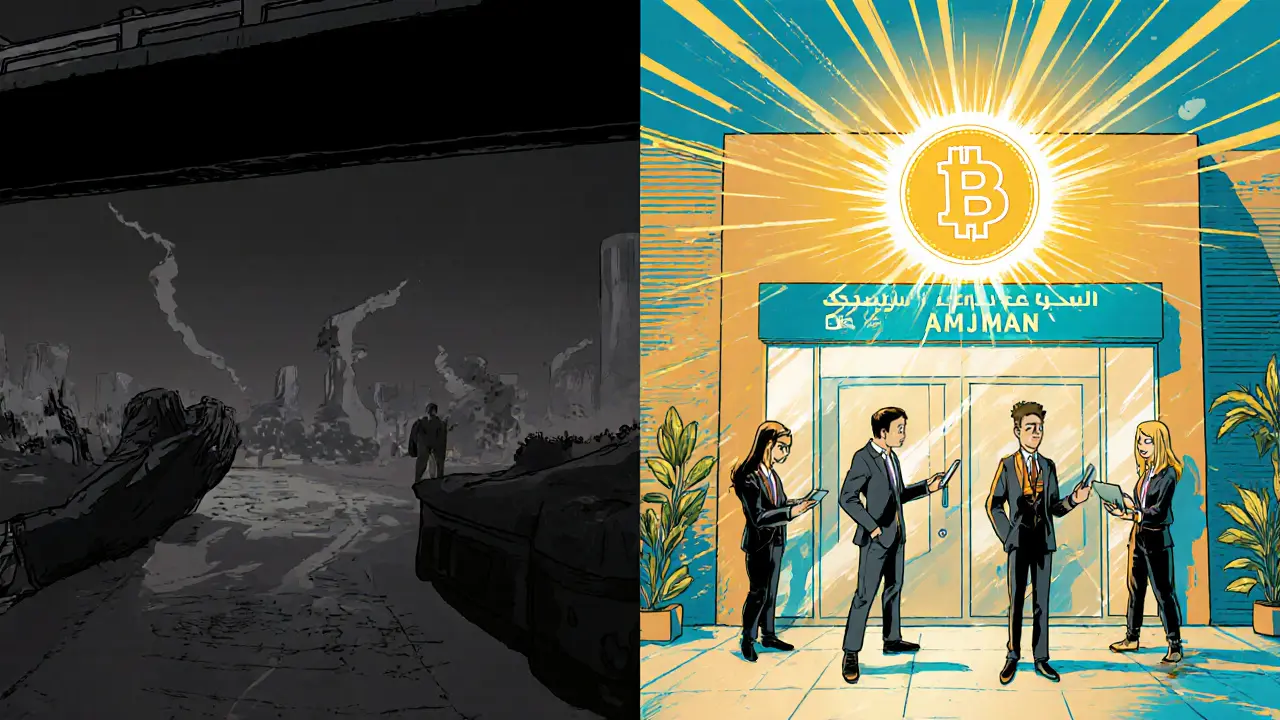

Trading in the Shadows

Jordanians didn’t stop buying crypto because the bank said no. They just went around it. The most common way? Peer-to-peer (P2P) trading. No middleman. No bank approval. Just two people, one with cash, one with Bitcoin, meeting in a café, a parking lot, or even a mosque courtyard after prayers. Some used WhatsApp groups. Others relied on word-of-mouth networks. A friend of a friend knew someone who knew a guy in Amman who could swap 500 JD for 0.01 BTC.It wasn’t glamorous. It was risky. You had no protection if the person disappeared. No recourse if the payment bounced. No insurance if your wallet got hacked. But it worked. And it was the only way.

Why not use international exchanges like Binance or Kraken? Because linking a Jordanian bank account to them was impossible. The banks blocked transactions to crypto platforms automatically. Even using a foreign bank account or PayPal was risky-banks monitored outbound transfers and flagged anything that looked like crypto-related activity. Some people tried using prepaid cards or cash deposits through third parties, but those methods often got shut down fast.

The Underground Network

A quiet ecosystem grew around this. Local traders became known by reputation. Someone who had done 20 successful trades over six months was trusted. You didn’t need ID. You didn’t need KYC. You just needed to show up with cash and a QR code. Some even used physical Bitcoin paper wallets-printed keys hidden in books or taped under tables-to avoid digital traces.Telegram channels became the new bulletin boards. One popular group, called “Jordan Crypto Swap,” had over 12,000 members before it was taken down in early 2024. Another, “Amman BTC Buyers,” ran daily buy/sell posts. Prices were set manually, often slightly above global rates to account for the risk. A Bitcoin that cost $60,000 on Binance might go for $62,500 in Jordan. That 4% premium? That was the tax you paid for operating outside the system.

Why the Ban? And Why Did It Fail?

The Central Bank of Jordan’s reasoning was simple: crypto is volatile, unregulated, and could be used for money laundering or terrorism financing. They cited risks to financial stability and consumer protection. But the ban ignored one big fact: Jordanians were already trading. Banning it didn’t stop demand-it just made it dangerous.Think about it. Jordan has one of the highest youth unemployment rates in the region. Young people were looking for ways to build wealth. Crypto wasn’t just speculation-it was a lifeline. Some used it to send money home to relatives abroad. Others used it to bypass currency controls when buying goods from overseas. A student in Irbid could earn crypto from freelance work on Upwork and cash out locally without waiting weeks for a bank transfer.

And then there was the brain drain. Talal Tabbaa, co-founder of CoinMENA, left Jordan in 2018 because he couldn’t build a crypto business there. He wasn’t alone. Dozens of talented Jordanian developers, fintech engineers, and blockchain entrepreneurs moved to Dubai, Singapore, or Berlin-places where crypto wasn’t just allowed, it was encouraged. The ban didn’t protect Jordan’s economy. It pushed its best minds away.

The Turning Point: Law No. 14 of 2025

On September 14, 2025, everything changed. King Abdullah II signed Law No. 14-the Virtual Assets Transactions Regulation Law. For the first time, crypto wasn’t illegal. It was regulated.The law defined virtual assets clearly: Bitcoin, Ethereum, stablecoins (as long as they’re not central bank digital currencies), and NFTs with economic value. It created a licensing system for exchanges, custodians, and payment providers. All must be registered with the Jordan Securities Commission (JSC) and have a physical office in Jordan.

Most importantly, it made P2P trading legal-if done through licensed platforms. No more hidden meetups. No more WhatsApp deals. Now, you could trade on a licensed exchange like CoinMENA or CryptoJordan, with full KYC, insurance, and dispute resolution. The old underground market didn’t vanish overnight-but it started to shrink.

What Changed After the Law?

Within three months of the law taking effect, three licensed crypto exchanges opened in Amman. Bank accounts could now be linked to them. Deposits and withdrawals worked like normal transfers. The premium on Bitcoin dropped from 4% to under 0.8%. People stopped paying extra for risk.Students started taking crypto courses at the University of Jordan. Local startups began building wallets and payment tools. Jordanian developers who had left for Dubai started coming back. One founder told a local newspaper: “I left because I couldn’t code here. Now I can build something real-and keep it here.”

But not everyone switched. Some older traders still prefer cash deals. They don’t trust government oversight. Others worry about privacy. But the trend is clear: regulation didn’t kill crypto in Jordan. It gave it a home.

What’s Left of the Old System?

You’ll still find the occasional P2P meetup in Rainbow Street or a Facebook group called “Jordan Crypto Cash.” But they’re not the main game anymore. The licensed exchanges are faster, cheaper, and safer. The government even runs public awareness campaigns: “Trade Crypto? Use a Licensed Provider.”The old risks? They’re still there-if you use unlicensed platforms. But now, you know the difference. And the law makes it illegal for anyone to promote or operate an unlicensed service. That’s a big deal. It shifts the burden from the individual to the platform.

What This Means for Jordan

Jordan isn’t the UAE. It won’t become a global crypto hub overnight. But it’s no longer the outlier. It’s catching up. And that matters.For the first time, young Jordanians don’t have to choose between their country and their future. They can build tech companies here. They can earn crypto from global clients and spend it locally. They can invest without hiding.

The banking restrictions didn’t stop crypto. They just made it harder. The 2025 law didn’t create demand-it just gave it a legal path. And that’s all it needed.

Can Jordanians still trade crypto using P2P methods after the 2025 law?

Yes, but only if done through licensed platforms. The law doesn’t ban P2P trading-it requires it to go through regulated exchanges. Personal cash deals outside licensed services are no longer protected and may be considered illegal if they involve unlicensed intermediaries. Most traders now use licensed platforms because they’re safer, faster, and legally recognized.

Why did Jordan ban crypto before 2025?

The Central Bank of Jordan banned crypto because it feared financial instability, money laundering, and consumer harm. Cryptocurrencies weren’t backed by any government, and transactions were anonymous. The bank believed this posed risks to the banking system and public finances. But the ban didn’t stop trading-it just pushed it underground, where risks were even higher.

Are crypto transactions taxed in Jordan now?

Yes. Under the 2025 law, capital gains from crypto trading are subject to income tax, and licensed exchanges are required to report transactions to tax authorities. The exact tax rate depends on individual income brackets, but the system is now transparent. Before 2025, taxes weren’t enforced because the market was invisible to regulators.

Can I use my Jordanian bank account to buy crypto now?

Yes-if you use a licensed virtual asset service provider. Banks now allow transfers to approved exchanges like CoinMENA, CryptoJordan, and others registered with the Jordan Securities Commission. You’ll need to complete KYC, but once you do, deposits and withdrawals work like any other online payment.

What happens if I use an unlicensed crypto platform after 2025?

You won’t be arrested for holding crypto, but using unlicensed platforms is illegal. If caught, you could face fines, and any funds involved may be seized. More importantly, you have zero legal protection-if the platform disappears or gets hacked, you can’t file a complaint or recover your assets. Licensed providers are required to carry insurance and follow strict security rules.

Did the 2025 law help Jordan’s economy?

Yes. The law reversed a years-long brain drain. Developers, fintech founders, and engineers who left for Dubai and Singapore are returning. Startups are launching locally. Foreign investors are showing interest. The Jordan Securities Commission estimates the virtual asset sector could add over $300 million to the economy in the next three years by creating jobs and attracting tech investment.