What Are Execution Layers and Settlement Layers?

Most people think of blockchains as single, all-in-one systems. You send a transaction, it gets confirmed, and that’s it. But that’s not how modern blockchains work anymore. Today, the most powerful and scalable blockchains are built like a stack of specialized tools - each part doing one thing, and doing it really well. That’s where execution layers and settlement layers come in.

Think of it like a restaurant. The kitchen is the execution layer - that’s where the food gets made, the orders are processed, the chefs are busy. The manager at the front who checks if the food was cooked right, handles complaints, and ensures the kitchen follows health codes? That’s the settlement layer. They don’t cook. They don’t serve. But without them, the whole system falls apart.

Execution Layers: Where the Action Happens

The execution layer is where users actually interact with the blockchain. When you swap tokens on Uniswap, mint an NFT on OpenSea, or stake your ETH in a DeFi protocol - all of that happens on the execution layer. It’s the part that runs smart contracts, updates account balances, and processes transactions.

But here’s the catch: if every single transaction had to go through Ethereum’s main chain, it would be slow and expensive. Ethereum can only handle about 15-20 transactions per second. That’s fine for sending money, but not for a high-volume DeFi app with thousands of users trading every minute.

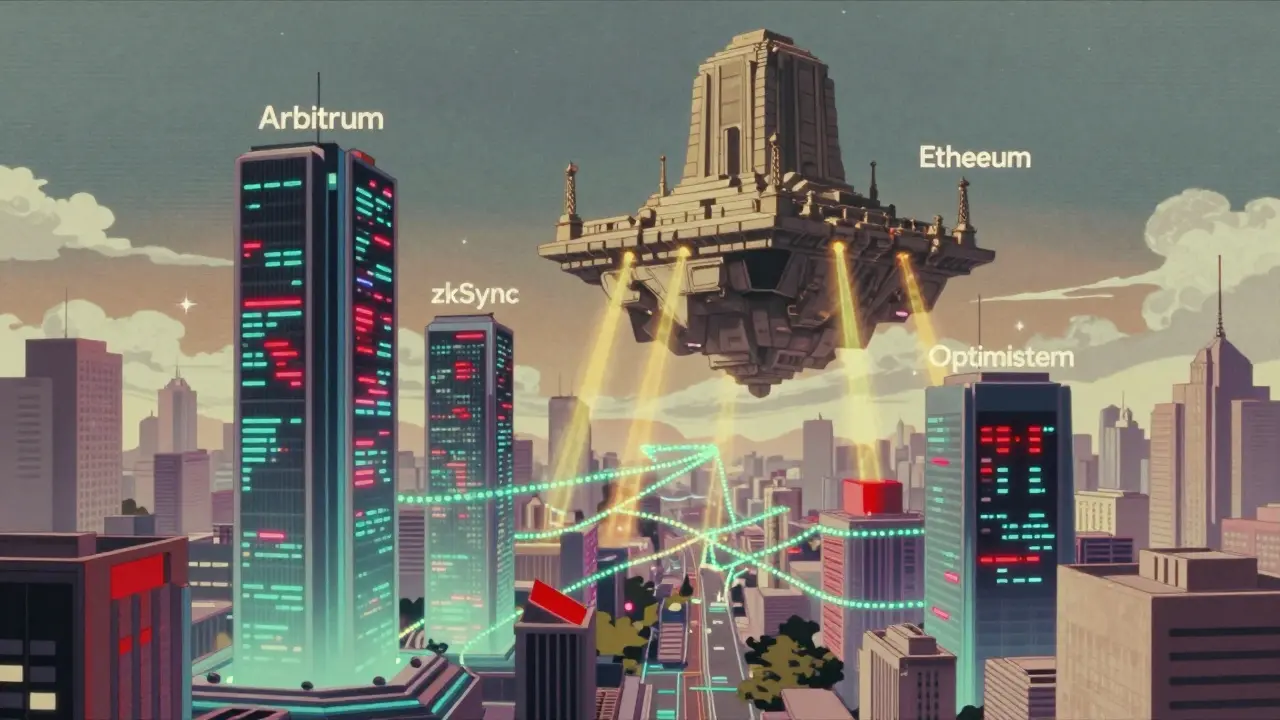

That’s where rollups come in. Rollups are the most common type of execution layer. They take hundreds or even thousands of transactions, bundle them up off-chain, and then send just one compressed proof back to the settlement layer. There are two main types:

- Optimistic Rollups (like Arbitrum and Optimism) assume transactions are valid unless someone proves otherwise. They give users a 7-day window to challenge suspicious activity - which is why withdrawals can take a week.

- ZK-Rollups (like StarkNet and zkSync) use advanced cryptography to prove transactions are correct right away. They’re faster and more secure, but harder to build.

Arbitrum One can handle up to 7,000 transactions per second. That’s over 350 times faster than Ethereum’s main chain. And because they’re built on top of Ethereum, they inherit its security - without the cost.

Settlement Layers: The Final Arbiter

The settlement layer doesn’t process transactions. It doesn’t run smart contracts. Its only job is to verify that what the execution layer claims is true.

Imagine you’re playing poker with friends. Everyone makes their moves, bets, and folds. But when someone claims they have a royal flush, you don’t just take their word for it. You check the cards. That’s what the settlement layer does. It checks the fraud proofs or validity proofs generated by the execution layer.

Ethereum is currently the dominant settlement layer. Every major rollup - Arbitrum, Optimism, zkSync, Polygon zkEVM - sends its final proof back to Ethereum. Ethereum then confirms, “Yes, this batch of transactions is valid,” and locks in the result. This gives rollups the same security as Ethereum’s main chain, even though they’re doing the heavy lifting off-chain.

But Ethereum isn’t the only option. New players like Celestia and Espresso Systems are building dedicated settlement layers. Celestia doesn’t even execute transactions - it just stores data and makes sure it’s available. Espresso focuses on fast, low-cost settlement across multiple blockchains. These aren’t replacements for Ethereum - they’re alternatives, giving developers more choice.

Why This Split Matters: Solving the Trilemma

For years, blockchain developers struggled with the “trilemma”: you can only have two out of three - decentralization, security, scalability. Monolithic blockchains like Bitcoin or old Ethereum tried to do everything in one layer. They were secure and decentralized, but painfully slow.

Modular blockchains break that trade-off. By splitting functions, each layer can optimize for its specific role:

- Execution layers focus on speed and low cost.

- Settlement layers focus on security and finality.

- Consensus layers (like Ethereum’s beacon chain) handle ordering and agreement.

- Data availability layers (like Celestia) make sure no one hides transaction data.

This is why the Ethereum L2 ecosystem exploded. In January 2022, the total value locked (TVL) in layer 2s was $1.2 billion. By October 2023, it hit $32.7 billion. Over 78% of all Ethereum transactions now happen on execution layers. That’s not a trend - it’s a revolution.

Real-World Impact: What This Means for You

If you’re using a DeFi app, you’re probably already on an execution layer. You might not even know it. When you trade ETH for USDC on Uniswap and pay 10 cents in gas instead of $10, that’s the execution layer doing its job.

For NFT collectors, it means minting a collection of 10,000 NFTs costs $200 instead of $20,000. For gamers, it means real-time in-game purchases without lag or insane fees.

But the real magic happens behind the scenes. The settlement layer is silently verifying every single one of those transactions. If someone tries to cheat - say, claiming they transferred 100 ETH when they only sent 1 - the settlement layer catches it. And because Ethereum is the most secure blockchain in the world, that verification is nearly impossible to fake.

Even if you’re not a developer, this shift affects you. Faster apps. Lower fees. More choices. That’s what modular blockchains deliver.

The Risks and Challenges

It’s not all perfect. Execution layers have trade-offs. Optimistic Rollups force users to wait 7 days to withdraw funds. That’s a bad user experience. ZK-Rollups are faster but require expensive, complex cryptography - only a handful of teams can build them.

Settlement layers have their own risks. If Ethereum ever gets hacked or experiences a major outage, every rollup relying on it could be affected. That’s called “settlement monoculture.” Some experts worry we’re putting too much trust in one chain.

Then there’s data availability. What if a rollup’s sequencer (the entity that orders transactions) hides some data? Without that data, no one can prove whether a transaction was valid. That’s why layers like Celestia exist - to guarantee the data is always available, even if the rollup goes down.

And while Ethereum dominates settlement today, that could change. New settlement chains like Espresso or Polygon’s zkEVM are gaining traction. If they prove faster, cheaper, or more decentralized, they could chip away at Ethereum’s 92.7% market share.

What’s Next?

The next big leap is Ethereum’s Verkle Tree upgrade, planned for 2025. It will shrink the size of proof data needed for settlement by 40-60%. That means lower costs, faster verification, and even more scalability for rollups.

Meanwhile, execution layers are getting smarter. Arbitrum’s AnyTrust tech can hit 40,000 TPS by trusting a small group of validators - a trade-off some apps are willing to make for speed.

Regulators are catching up too. The EU’s MiCA law, effective December 2024, treats settlement layers as critical infrastructure. That means they’ll need stricter audits and security standards.

By 2030, most experts believe modular blockchains will be the norm. Monolithic chains won’t disappear - Bitcoin will still be used for simple transfers - but for anything complex, scalable, or user-facing, modular will win.

Final Thoughts

Execution layers and settlement layers aren’t just technical buzzwords. They’re the foundation of the next generation of blockchain apps. They let us build faster, cheaper, and more powerful decentralized systems without sacrificing security.

The future isn’t one blockchain to rule them all. It’s a network of specialized layers, each doing its job perfectly. And right now, Ethereum is the anchor holding it all together.

What’s the difference between an execution layer and a settlement layer?

The execution layer processes transactions and runs smart contracts - it’s where users interact with apps. The settlement layer verifies those transactions and resolves disputes. It doesn’t run apps; it just confirms they’re valid. Think of execution as cooking and settlement as health inspection.

Why does Ethereum handle most settlement?

Ethereum has the strongest security, largest developer base, and deepest liquidity. Rollups use it because it’s the most trusted and hardest to attack. Even though it’s slow, it’s reliable - and that’s what settlement needs more than speed.

Can I use a settlement layer without using Ethereum?

Yes. Projects like Celestia, Espresso Systems, and Polkadot offer alternative settlement layers. They’re still new, but they’re growing. Some developers are testing them to reduce reliance on Ethereum and lower costs.

Are ZK-Rollups better than Optimistic Rollups?

It depends. ZK-Rollups are faster and have instant finality, but they’re harder and more expensive to build. Optimistic Rollups are easier to develop for and support more complex smart contracts - but users must wait 7 days to withdraw. Most apps today use Optimistic Rollups because they’re more flexible.

How do I know if I’m on an execution layer?

Check your wallet’s network. If you’re connected to Arbitrum, Optimism, zkSync, or Polygon zkEVM, you’re on an execution layer. Your gas fees will be under $0.10, and your transactions will be near-instant. Ethereum mainnet will show higher fees and slower confirmations.

What happens if the settlement layer fails?

If the settlement layer goes down or gets compromised, all execution layers relying on it could be at risk. Transactions might not finalize, withdrawals could freeze, and fraud proofs might not be verified. That’s why Ethereum’s security is so critical - and why alternatives are being built.