Clams (CLAM) Value Calculator

Current CLAM Value

Based on September 2023 data: $0.02 USD per CLAM with 291,898 CLAM in circulation.

Enter your CLAM amount and target price to see your potential value.

When people ask “What is Clams (CLAM) crypto coin?” Clams (CLAM) is a proof‑of‑stake cryptocurrency launched in 2014, built on a fork of the Bitcoin protocol. It’s one of those early‑stage tokens that many have never heard of, but it still exists on the blockchain and shows up on a few obscure exchanges.

Key Takeaways

- Clams started in May 2014 and uses a proof‑of‑stake (PoS) model instead of mining.

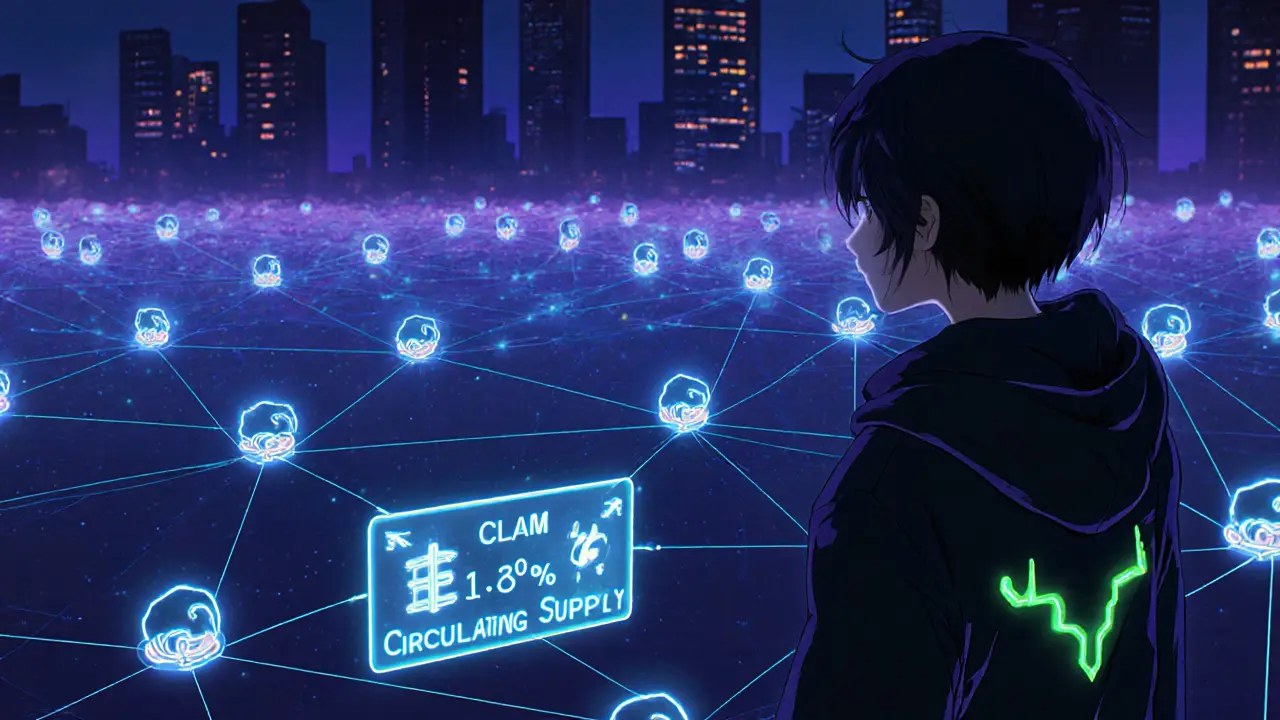

- Maximum supply is 17millionCLAM, but only about 1.7% has ever been distributed.

- Daily trading volume is under $20, making liquidity a huge problem.

- The only real wallet that supports CLAM is the Komodo Wallet.

- Most experts label it a “zombie protocol” - it lives on the chain but sees almost no use.

Background and Origin

The code behind Clams was released on May152014, just a year after Bitcoin’s debut. The developers never revealed their identities, which is pretty common for small coins launched in that era. Their goal was simple: offer fast, cheap transactions without the energy‑hungry mining that Bitcoin required.

Unlike Bitcoin’s proof‑of‑work, Clams switched to Proof‑of‑Stake a consensus method that lets holders validate blocks by staking their coins. In theory, this cuts electricity use and lets anyone with a few CLAMs earn staking rewards.

How Clams Works - Consensus and Supply

The PoS algorithm means there’s no mining hardware to buy, but it also makes the network vulnerable if very few people hold the token. As of September2023, only 63,381 addresses held a total of 291,898.39CLAM - roughly 1.72% of the 17million‑coin cap. If every “dug” coin were claimed, the supply would reach about 15million, but that scenario is far from reality.

Staking rewards are paid out automatically to wallets that lock up CLAM, but the tiny holder base means rewards are modest and the network’s security margin is thin.

Current Market Situation

Clams lives in the shadows of the massive crypto market. In October2023, the 24‑hour trading volume across all decentralized exchanges was just $0.0169, according to CoinGecko a leading crypto data aggregator. The price hovers around a few thousandths of a Bitcoin, equating to roughly $0.02 USD per token.

Because liquidity is so low, any trade you try to make can slip 20%‑plus in price. One Reddit user reported waiting three weeks to sell a small stash and ending up 40% below the listed price on the only active exchange - Komodo Wallet’s CLAM/KMD pair.

Where to Store and Trade Clams

The only wallet with built‑in support for CLAM is the Komodo Wallet a multi‑currency desktop wallet that also runs a decentralized exchange. Setting it up takes about 15minutes, but finding a buyer inside the app is another story.

Aside from Komodo, two tiny exchanges list CLAM - YoBit and a little‑known “Freiexchange”. Both show daily volumes in the single‑digit dollars, so expect large spreads and possible failed transactions.

Pros and Cons

- Pros

- Zero‑fee transaction model (theoretically).

- Instant confirmation - no 10‑minute block wait like Bitcoin.

- Proof‑of‑stake means no mining hardware needed.

- Cons

- Almost no liquidity - you’ll struggle to sell.

- Developer activity stopped in 2018; no updates since.

- Very small holder base, which weakens network security.

- Not listed on any major exchange, limiting exposure.

Comparison with Other Coins

| Metric | Clams (CLAM) | Bitcoin (BTC) | Cardano (ADA) |

|---|---|---|---|

| Launch year | 2014 | 2009 | 2017 |

| Consensus | Proof‑of‑Stake | Proof‑of‑Work | Proof‑of‑Stake |

| Max supply | 17million | 21million | 45billion |

| Circulating supply (Sept2023) | 291,898CLAM (≈1.7%) | 19.4millionBTC | 34.5billionADA |

| 24‑hr volume (USD) | $0.02 | $58billion | $1.2billion |

| Typical transaction fee | ~$0 (theoretically) | $2‑$5 | $0.15 |

The table makes it clear why CLAM is a niche relic. Its market cap is a fraction of a cent compared to Bitcoin’s multi‑trillion valuation.

Is Clams Worth Holding?

If you already own a few CLAM from the early days, the decision is personal. The coin’s price is so low that even a 100% jump would barely move the needle in your portfolio. On the other hand, holding onto a “museum piece” may be fun for collectors who enjoy early‑crypto history.

For anyone looking to invest now, the odds are not in CLAM’s favor. Liquidity is near‑zero, developer support is dead, and the only realistic use‑case is peer‑to‑peer swaps among a tiny community. Most analysts label it a “zombie protocol” and recommend treating it as a curiosity rather than a growth asset.

Frequently Asked Questions

What does CLAM stand for?

CLAM is simply the ticker symbol for the Clams cryptocurrency. The name doesn’t expand into an acronym; it was chosen as a short, memorable token name.

How can I buy CLAM?

Your best bet is the Komodo Wallet’s built‑in DEX. You’ll need another crypto (like KMD or ETH) and then swap it for CLAM. Expect huge price slippage because of the tiny market.

Is staking CLAM profitable?

Staking rewards exist, but with only a few hundred thousand coins in circulation, payouts are minimal. Most users earn less than $1 per year on a few hundred CLAM.

Are there any real‑world merchants that accept CLAM?

No. Searches of merchant directories and payment processors show zero acceptance. CLAM is effectively a peer‑to‑peer token only.

What are the biggest risks of holding CLAM?

Liquidity risk (you might not be able to sell), security risk (few validators), and regulatory risk (the SEC could classify it as a security). Plus, the project has no development activity.